What are propensity models?

Propensity models,also called likelihood to buy or reponse models, are what most people think about with predictive analytics. These models help predict the likelihood of a certain type of customer purchasing behavior, like whether a customer that is browsing your website is likely to buy something. This helps marketers optimize anything from email send frequency, to sales staff time, to money, including discounts.

An example of a company using predictive analytics using the propensity model: Online pet pharmacy PetCareRx has served pet owners for more than 15 years. It sells many products that customers have to reorder at varying times from three months to 12 months. Like most retailers, PetCareRx took a one-size-fits-all marketing approach, offering a set calendar of discounts and promotions to all customers. But not all customers are alike and many are looking to buy at different times of the year.

Using predictive analytics, PetCareRx was able to differentiate discounts across customers, leading to higher sales and retention without increasing costs. Customers were ranked according to their likelihood to buy. Based on that ranking, PetCareRx was able to determine which discounts would obtain the optimal response from each customer and offer minimal discounts through email or mailed postcards to customers who were already deemed likely to buy and offer larger discounts for customers who were less likely to buy. The surgical promotions drove incremental margin from customers who were already motivated to buy and incremental revenue from customers who previously felt no incentive to buy.

Thanks to this and other predictive marketing campaigns, quarterly sales increased by 38 percent from the year before, profit rose by 24 percent, and customer retention increased by 14 percent. Plus, the changes allowed PetCareRx to more than double its campaign response rates without increasing the marketing or promotional budget by a single dollar.

How to Use Likelihood to Buy Predictions

To predict which prospects are ready to make their first purchase, a likelihood to buy model evaluates non-transaction customer data, such as how many times a customer clicked on an email or how the customer interacts with your website. These models can also take into account certain demographic data. For example, in consumer marketing they may compare gender, age, and zip code to other likely buyers. In business marketing, relevant demographics may include industry, job title, and geography.

Here’s how it works: the models compare the pre-purchase behavior of prospective buyers to the pre-purchase behavior of thousands or millions of previous customers who ended up buying, comparing attributes like what emails they opened and what products they spent the most time looking at. The prospects that behave most like the previous buyers are tagged as “high-likelihood buyers” and marketers can then alter the way they interact with them to increase the likelihood of closing a sale. Once you’re armed with this data, you can prioritize your investment in each prospective customer.

Predicting Likelihood to Buy for First-Time Buyers

For consumer marketers, likelihood to buy predictions allow you to decide how much of a discount you might allocate to a certain customer because people who are already more likely to buy won’t need as aggressive of a discount as customers who are less likely to buy. The models then get better over time, as companies collect more data and automatically test whether predictions actually become reality.

For instance, the large European household appliance manufacturer Arcelik maintains a call center where employees are given a list of customers who are likely to be ready to buy a new washing machine within the next few months. Agents then make calls to these customers with offers such as a year of free detergent with the purchase of a washing machine. The tactic works well for considered purchases, such as refrigerators or cars, and larger-ticket items such as high-end fashion apparel.

A high-end shoe brand provides store associates with lists of customers to call too. The store associates have already developed strong relationships with their customers, but they can be even more successful when armed with predictive analytics. Employees can now see which customers are likely to be interested in a certain style when a new season’s shoe comes out, based on customers’ past behavior or how similar their purchase habits are to other customers. Employees can then reach out to customers with that information. A call could go something like this: “Hi Joe, it has been a while since we’ve spoken. I just wanted to let you know that there is a new cross-country running shoe I think you might like. It’s similar to the shoes you bought two years ago, but in a new material. I have put a pair aside for you in your size. If you have time, perhaps you could stop by on your way home from work to have a look?” Who would not want to receive a call or an email like that from their personal shopper?

As reported by the New York Times and others, President Barack Obama used propensity models, specifically propensity to vote for the Democratic Party, to help him win reelection in 2012. His staff of volunteers could not possibly meet with every voter in the country so the challenge was to find the undecided voters. There was no point spending time or money trying to woo diehard Republicans who would not change their minds anyway, or diehard Democrats who were already likely to vote for Obama. Rather, using propensity models, Obama’s team of data scientists found those voters who were undecided but could still be persuaded. They then focused on finding already strong Obama supporters in the undecided voter’s social circle and asked them to spend time with the undecided voter to explain their views.

Predicting Likelihood to Buy for Repeat Buyers

What good is spending money to acquire new customers if they only buy once and do not return? Based on a customer's propensity to purchase, it is not only important to predict likelihood to buy for first-time buyers, but it is equally important to predict likelihood to buy for repeat buyers. Your goal is to keep customers coming back time and time again. It is happy and loyal customers who have a large lifetime value, and many customers with a large lifetime value make for large revenues and profits for your company.

Predicting likelihood to buy for repeat buyers is a lot easier than predicting likelihood to buy for first-time buyers because there is a lot more information to go on. The likelihood to buy model for repeat purchases evaluates earlier transactions as well as other interactions similar to the model for prospects. However, the added information derived from the first purchase can significantly improve the accuracy of the likelihood to buy model for repeat purchases, as compared to a similar model for prospects. Unlike the first purchase predictions, repeat purchase predictions utilize all interactions of the customer, such as past purchases, returned purchases, and phone calls to customer service.

Choosing the Right Level of Discount Using Likelihood to Buy

There are two main uses for likelihood to buy predictions: which customers to focus on and how much money, including discounts, to spend on each customer.

Choosing your audience carefully is important if you want to optimize marketing ROI, because reaching customers can be expensive. For instance, a direct mail or call campaign that costs $1 per customer interaction and has a 2 percent purchase rate could cost $50 a person before a discount is even given. If you can target your audience and make the communications more relevant, the purchase rate could be significantly higher, say 10 percent, reducing the cost to reach each buyer significantly. In addition to choosing the right people, you can increase purchase rates by including relevant recommendations or content and to communicate with customers at the right time. Focusing on relevancy will allow companies to reduce their dependency on high discounts. Using this strategy, it is possible to significantly reduce discounts as a part of their customer acquisition strategy.

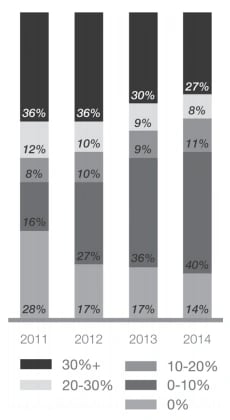

The below chart shows how a large U.S. retailer was able to reduce the number of customers lured by high discounts from 36 percent to 27 percent, well below the industry average of 31 percent.

Percentage Customers Acquired with Discounts

Discounts and other incentives can still be used as a sweetener in necessary cases, such as targeting a customer who has abandoned her cart. However, we recommend you do not give out discounts to everybody or else you will train your customers to get used to discounts.

Instead, start with recommendations and reminders and use discounts only if you need them. The lack of understanding of the individual customer leads to blanket discounts, which reduces overall profit margins considerably. Only about 20 percent of customers are “discount junkies,” people who will only make purchases when given a discount, according to an analysis of 150 retailers. About 15 percent generally pay full price for most of their products, while the majority of customers fall somewhere in between, the data show. By analyzing their customers’ behavior, marketers can determine which customers may need more encouragement in the form of a gift or discount. It can also help marketers flag customers who will come back and buy anyway, so no additional monetary encouragement is needed. This model helps to maximize both revenue and profitability from each member of your customer base.

Targeting discounts is good for business and good for customers. By surgically targeting discounts, retailers avoid margin erosion, which in turn reduces the price increases retailers would normally have to take to make up for the lower profit margins. That practice effectively lowers prices for all customers. This is a simple but very powerful paradigm shift for marketers who traditionally focus on product lines, merchandising, and one-size-fits-all discounting. Behavioral and lifecycle data available at the customer level combined with the predictive insight about likelihood to buy allows marketers to surgically discount to maximize margin and customer lifetime value.

Also, if you are going to include an incentive or discount to acquire, retain, or reactivate a customer, there is no need to go beyond the level of discount that customers are used to seeing. Predictive analytics allows you to tailor offers based on what level of discount triggered past customer purchases. Customers with a high likelihood to buy may get a lower discount but perhaps other perks such as early access to products to drive more purchases. Customers with a low likelihood to buy or those who only buy on discount (a behavior-based cluster) might get a higher discount.

A multichannel retailer of sports goods used to send all of its customers a 50 percent clearance discount at set times during the year. This campaign was motivated by its desire to clear old inventory. In other words, it was a product or merchandising-centric campaign, not a customer-centric campaign. This campaign trained customers to wait for the big annual sale and brought in few dollars for the retailer. Using predictive analytics, this company analyzed the likelihood to buy and discount sensitivity of all of its customers. If a customer is likely to buy with an offer of 25 percent off, you don’t need to give them a 50 percent discount. Using predictive analytics, the retailer identified the right discount level for different groups of customers. Now the retailer still sends discount emails at set times, but it will send different levels of discounts to different groups of customers. It sends just enough to get the customer to buy, but not too much to give away unnecessary margin. Using this approach, the retailer was able to achieve an overall increase in revenues of 20 percent.

Predictive Lead Scoring for Business Marketers

If you are in business marketing you can equally prioritize your investment using likelihood to buy models. You can ensure that your sales team spends most of their time with the prospects that have the highest likelihood to become buyers. This can have an enormous impact.

Consider the following example in marketing business software. Let’s say you have a free trial for your software. Not all people who sign up for your free service have a serious intent to buy. It is not uncommon that 70 percent of free-trial signups are made just out of curiosity without an immediate need or budget to buy. Another 20 percent are serious evaluators and 10 percent are on the fence: they could go either way. If you randomly call people from a list, perhaps based on company size, it is easy to see how you may end up wasting your entire day on prospects that aren’t serious. It is especially important to prioritize your time if you are serving small- and medium-size businesses, of which there may be millions.

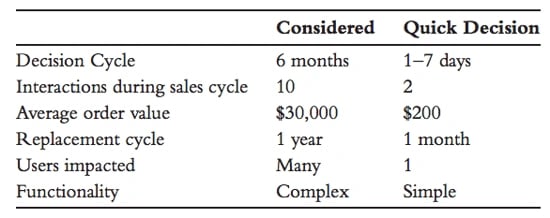

The main difference between predicting likelihood to buy in consumer and business marketing is due to the nature of the purchase decision process. In most business marketing, the decision process is long and complex.

Compares the considered and quick decision processes.

With a considered purchase, which most business marketing falls under, the decision process is longer and includes many interactions between the marketer and the buyer. This requires special attention to focus on all prospects within the decision funnel. Hence business marketers turn to all interactions and signals from prospects to determine who is most likely to buy and therefore worthy of time and attention.

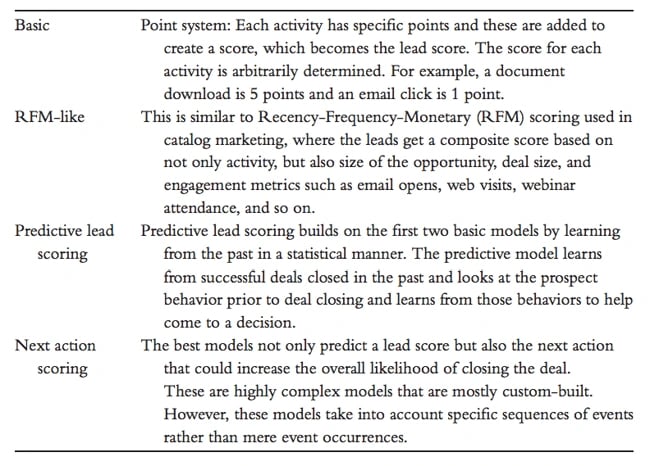

The below gives an overview of lead scoring methods beyond predictive methods.

Because the replacement and delivery cycles for vendors, deals, services, and products can take a long time, most B2B marketers are hyperfocused on acquiring new customers, rather than getting existing customers to come back, where likelihood to buy first purchase models take greater importance.

Predictive models are not the only way to prioritize prospects for business marketers. However, predictive models are by far the most accurate and relatively easy to use.

Excerpted with permission of the publisher, Wiley, from Predictive Marketing: Easy Ways Every Marketer Can Use Customer Analytics and Big Data. Copyright (c) 2015 by Omer Artun and Dominique Levin. All rights reserved.

![Download Now: Sales Conversion Rate Calculator [Free Template]](https://no-cache.hubspot.com/cta/default/53/059a7eef-8ad9-4bee-9c08-4dae23549a29.png)