You’ve put together a business plan, invested all your savings, and have been working on your idea as a side hustle for a few months. Finally, you feel like it’s the right time to take the leap and raise some real capital. Does this sound familiar?

Luckily, the bank isn’t your only option to fund your business venture these days. Crowdfunding sites offer a viable alternative to more conventional financing methods. Whether you’re funding the next hottest startup, a creative endeavor, or a cause-based organization, you’ll find a crowdfunding site below to help you hit your goal quickly.

Download Now: 2024 Entrepreneurship Trends Report

Table of Contents

- Business Crowdfunding

- Best Crowdfunding Sites

- Choosing the Right Crowdfunding Site

- We asked entrepreneurs who ran successful crowdfunding campaigns: “What worked well for you, and what tips can you offer?”

Business Crowdfunding

Crowdfunding is a way for small businesses or startups to raise money in exchange for equity, rewards, debt, or nothing at all. Business crowdfunding can provide you with fast access to cash, but it requires a strong promotional strategy, transparency, and possibly giving up some equity in the business.

If you‘re an entrepreneur, odds are you’ve heard of crowdfunding by now — so the definition above might not be anything new. The process has become extremely popular in recent years, and while you probably have a baseline understanding of what “crowdfunding” means, you might not know about the concept's nuances.

The term doesn't cover a single brand of fundraising — there are more than a few types of crowdfunding, including:

- Equity crowdfunding: This is probably the most traditional kind of crowdfunding listed here. With equity crowdfunding, You sell a piece of your business to an investor (or groups of investors) and they provide you with the capital to move your business forward.

- Donation crowdfunding: If you're a nonprofit or local business, donation-based funding might work for you. It simply requires you to create a campaign asking for donations for your business. The money is donated, and there is nothing to repay.

- Debt crowdfunding: Also called “marketplace” funding, debt crowdfunding is when business owners borrow money from other individuals, instead of from a bank. You borrow at a set annual percentage rate, and loans are often structured similarly to those of a traditional business loan.

- Rewards crowdfunding: This is likely the most well-known type of crowdfunding. Made popular by sites like Kickstarter, funders are offered products, services, or other gifts in exchange for a set donation amount. For example, if I'm trying to fund my dog walking business, I might offer one hour of puppy snuggles to anyone who donates $50. For those donating $100, I might offer one hour of puppy snuggles plus a free grooming session.

Entrepreneurship Trends Report

Unlock the future of entrepreneurship with this free report from HubSpot and The Hustle.

- 92% of entrepreneurs have no regrets about starting their business.

- 61% find customers through powerful word-of-mouth referrals.

- 37% of entrepreneurs are targeting higher ARR in the next year.

- And more trends!

Download Free

All fields are required.

Best Crowdfunding Sites

1.Kickstarter

Kickstarter is more or less the quintessential crowdfunding platform. Since its inception in 2009, the site has supported over 260K successful projects, generated $8B in pledges to businesses, and facilitated 95M individual total transactions. It features a straightforward interface and covers a pretty massive range of projects — from games to creative pursuits to emerging tech.

What we like about Kickstarter: Kickstarter‘s value lies primarily in its reputation. Again, it’s probably the most prominent crowdfunding platform on the Internet, and that esteem didn‘t come arbitrarily. You know what you’re getting with Kickstarter — a reputable forum for generating interest from backers that shows your business is legit.

Price: It’s free to create a project on Kickstarter, but if it’s successfully funded, Kickstarter applies a 5% fee to the collected funds. There will also be processing fees between 3% plus $0.20 per pledge.

Best for: Entrepreneurs who feel they can facilitate their own buzz and dedicated community engagement.

2.Indiegogo

Indiegogo is also one of the more popular sites in the crowdfunding space, but it's a bit more focused than Kickstarter. The platform only showcases groundbreaking products and emerging tech, whereas Kickstarter also covers services and creative media.

But that focus doesn‘t necessarily limit Indiegogo’s range of offerings. The platform has supported 800k successful projects since 2008 with the support of over 9M backers. Indiegogo is also unique in the fact that it doesn't enforce any fundraising targets or deadlines — giving you a bit more wiggle room and flexibility when promoting your product.

What we like about Indiegogo: Indiegogo offers entrepreneurs a combination of visibility and flexibility. It‘s a high-profile platform that doesn’t impose a lot of pressure or time-binding restrictions on entrepreneurs.

Price: Indiegogo charges a 5% platform fee for all projects, along with a fee of 3% and $0.20 per transaction.

Best for: Entrepreneurs looking to promote innovative products and emerging tech.

3.Crowd Supply

Crowd Supply’s mission is to “bring original, useful, respectful hardware to life.” Whether you want to bring a family recipe to market, create cutting-edge open hardware, or build electronics, Crowd Supply can help. 80% of launched projects have been successfully funded and the average amount raised per successful project is $61,000.

What we like about Crowd Supply: This crowdfunding space dedicates its platform to giving visibility to hardware projects at a time when software-focused companies are at the forefront.

Price: Crowd Supply is paid based on a percentage of product sales during your campaign — typically 12%. The service doesn't take equity.

Best for: Entrepreneurs developing visible hardware products.

4.Fundable

Create a profile, then choose whether you’d like to raise funds by selling your product, taking pre-orders, and selling merchandise — or by raising funds from accredited investors. The former, the rewards program, is recommended for consumer-facing companies aiming to raise up to $50,000. The latter, the equity program, is recommended for between $50,000 and $10 million funding goals for product, service, or B2B businesses.

What we like about Fundable: Fundable recognizes that B2B and B2C businesses operate differently, and therefore source funding differently. The company tailored the path for B2B and B2C ventures to both succeed on the platform.

Price: It’s free to create a company profile then $179/month to fundraise. There are no success fees, but for rewards-based raises, there is a processing fee of 3.5% + $.30 per transaction.

Best for: Both B2B and B2C startups.

5.WeFunder

WeFunder allows you to raise between $50,000 and $50 million from investors. Most campaigns take between one and three months to reach their goals. From breweries and restaurants to tech startups and fashion businesses, you’ll be able to solicit funds from WeFunder’s more than 150K investors.

What we like about WeFunder: In just 15 minutes, you can begin raising funds for your next venture by creating a free account to get started.

Price: It’s free to create a profile. WeFunder doesn’t charge management or transaction fees. Administrative fees are charged to investors which covers all the costs of operating WeFund.

Best for: Startups and small businesses seeking equity investment.

6.Crowdcube

Crowdcube is an equity crowdfunding platform built to turn your friends, family, fans, and customers into investors. They’ll help you set realistic targets, a sensible valuation, an effective pitch, and a well-executed communication plan to unlock Crowdcube’s investor community.

You’ll launch publicly when your pitch reaches 20% of the goal you set. If that's not enough encouragement, the average pitch reaches its full target in just 22 days. At 75% funding, Crowdcube’s legal team will become involved to help complete your round quickly.

What we like about Crowdcube: Crowdcube supports seed, early, and growth-stage finance options so you can continue using the same platform as your venture scales to new heights.

Price: There are no fees for listing your business on Crowdcube. You’ll be charged a success fee of 7% on the amount you successfully raise, and payment processing fees also apply.

Best for: Startups and growing businesses seeking equity investment, primarily in the UK.

7.Funding Circle

Expand, hire staff, or fund your next step with fast, affordable business loans. They’ve funded veterinary clinics, cosmetics brands, and more. Interest rates run between 4.99% and 26.99% per year, and you’ll repay in between six months and five years. There are no prepayment penalties, and you can borrow between $25,000 and $500,000. Simply fill out an online application, enjoy a dedicated account manager, and get a fast decision.

What we like about Funding Circle: You don‘t need to be a finance expert to benefit from this platform. If you’re not sure what type of funding is right for you, Funding Circle can help you figure it out with a six-minute application.

Price: Besides possibly steep interest rates, you’ll pay an origination fee of between 0.99% and 6.99%. There’s also a 5% charge on late payments.

Best for: Small and medium-sized businesses in need of loans.

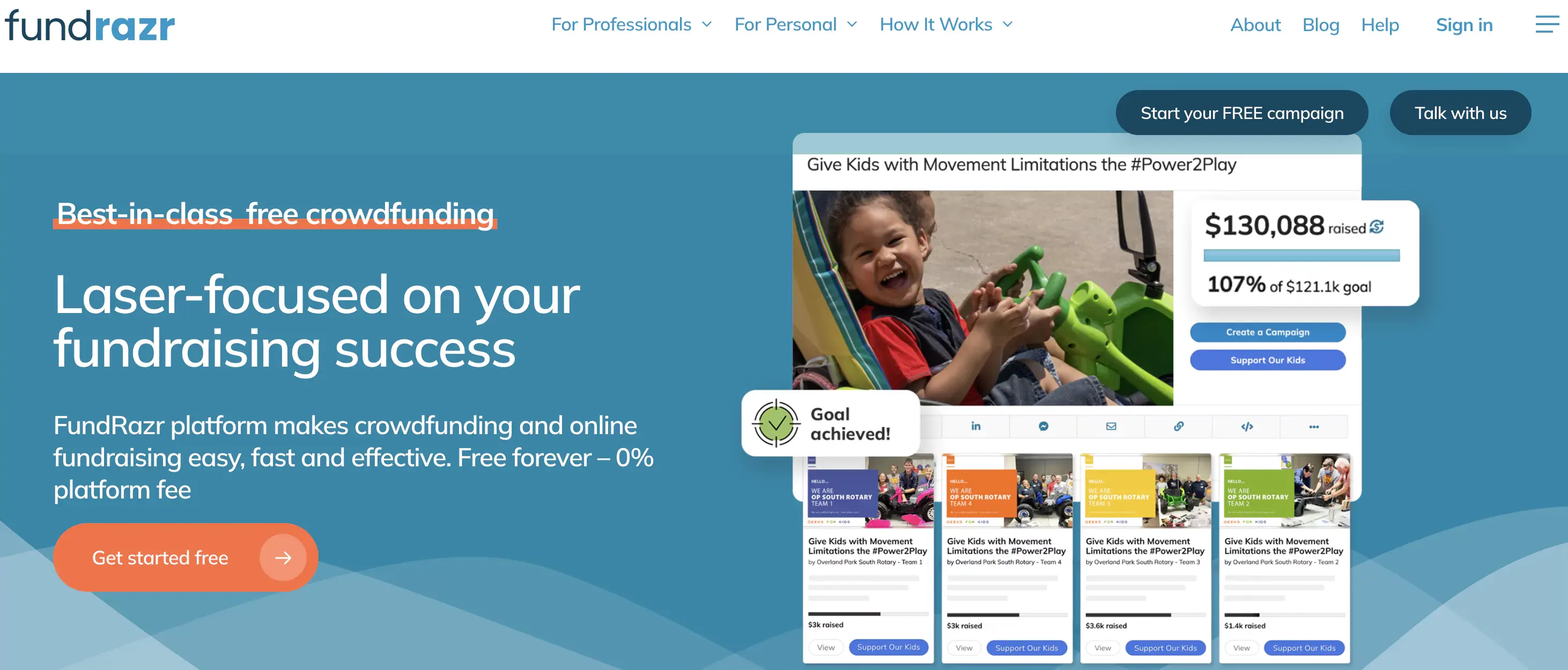

7.FundRazr

FundRazr is a crowdfunding site built for individuals, nonprofits, and businesses. Their platform is built with ease of use as the priority with no complicated tech setups. However, they do offer website and CRM integrations, recurring donations, incentives, and secure payment processing.

What we like about FundRazr: Nonprofits, individuals, and businesses can use Fundrazr to raise capital for business ventures or personal causes.

Price: You can choose from their multiple pricing models, whether you need supporters to take care of the fees, you want to keep it simple, or you want the flexibility to design custom pricing. However, there is no setup or monthly/annual fee for any of the pricing structures. Two of the pricing structures have a payment processing fee of 2.9% plus $0.30 per transaction, but with the Pro Model, you can build it into your plan.

Best for: Individuals, nonprofits, and organizations raising funds for various causes, projects, and campaigns.

8.Ulule

Ulule is the leading crowdfunding platform in Europe and offers international crowdfunding. When you start a project on Ulule, you set a fundraising goal. If you do not reach the goal, the donations are refunded to your backers and you don't have to pay any fees. However, Ulule maximizes success through its approval process and support to fundraisers by giving advice on displaying the project and using the platform.

What we like about Ulule: If you don't have extra funds to dedicate to marketing your fundraising campaign, Ulule makes it easy for supporters to find causes that align with their personal values and back them with financial support.

Price: Ulule takes a commission based on the currency and payment method that's used. Check here for more information on their pricing.

Best for: Creators, entrepreneurs, and nonprofits in Europe seeking funding for creative and innovative projects.

9.CircleUp

CircleUp helps startups in the consumer goods space secure capital through credit and equity crowdfunding. By applying to work with CircleUp, you'll be able to speak to credit advisors to determine the best financing solutions for your business.

What we like about CircleUp: This platform uses a technology called Helio that helps predict the next big breakout companies with untapped potential.

Price: Determined on a case-by-case basis.

Best for: Consumer brands and companies seeking equity investment.

10.EquityNet

EquityNet helps connect entrepreneurs with accredited investors in order to raise business capital. The platform has been around since 2005, and there are more than 25,000 investors in the network. Unlike other crowdfunding sites, EquityNet accepts all legal and ethical companies who apply, and they don't take a commission.

What we like about EquityNet: There are three different plan options to choose from: Starter, Premium DIY, and Full Service. These range from free to $2,000+ so there's an EquityNet plan for startups at just about every maturity stage.

Price: There's no platform fee or commission. However, you may need to pay a subscription fee of $199 per month to access their more advanced features.

Best for: Startups and businesses looking for equity, debt, or royalty-based funding.

11.Seedrs

Seedrs is another equity crowdfunding platform that connects entrepreneurs with investors, allowing buyers and investors to exchange shares. The platform isn't just for fundraising and connecting to investors, either; it helps entrepreneurs network and acquire customers as well, all from the same platform.

What we like about Seedrs: Seedrs simplifies the fundraising journey to just six steps — simple for first-time fundraisers who want a little more guidance.

Price: If the fundraiser is successful, you'll be charged a 6% fee plus payment processing. In addition, there's a £2,500 completion fee that covers administrative support such as communicating with investors.

Best for: Startups and growing companies seeking equity crowdfunding, primarily in Europe.

Choosing the Right Crowdfunding Site

- Determine the type of funding you need.

- Calculate how much funding you need.

- Understand the fees associated with the crowdfunding site you choose.

- Choose multiple sites to appeal to diverse audiences.

- Read the fine print to ensure you can meet the requirements to claim your funds.

1. Determine the type of funding you need.

As you can tell from the list of 11 unique platforms covered above, you have a wide range of crowdfunding options that cover an equally wide range of bases — so if you want to crowdfund as thoughtfully and effectively as possible, you need to pin down which one best suits your needs. That starts with you understanding what kind of funding you need.

Do you want to offer investors equity? Do you want to incentivize individual contributions with access to your offering? Do you want to source donations for a mission-driven, philanthropic pursuit?

If you can't answer the question, “What type of funding do I need?” you run the risk of choosing a site that doesn't align with your goals and preferences — potentially undermining how much value you can get out of your crowdfunding efforts in general.

Entrepreneurship Trends Report

Unlock the future of entrepreneurship with this free report from HubSpot and The Hustle.

- 92% of entrepreneurs have no regrets about starting their business.

- 61% find customers through powerful word-of-mouth referrals.

- 37% of entrepreneurs are targeting higher ARR in the next year.

- And more trends!

Download Free

All fields are required.

2. Calculate how much funding you need.

The most effective crowdfunding efforts are backed by SMART goals — and the “specific, measurable, and attainable” elements are especially crucial when selecting a crowdfunding site.

You need a definitive sense of the amount of funding you need and, in some cases, can reasonably accommodate when selecting an appropriate crowdfunding platform. Having that understanding allows you to gauge some key aspects of your preferred platform — like the degree of visibility you'll need and the kinds of investors you want to attract.

You might also need to set a maximum amount of funding to raise. Promoting your business on a platform like Kickstarter — where you often offer access to your product if you reach your fundraising goal — might “get away from you” if you raise too much. There's a chance you might lack the resources or ability to deliver your product to everyone who sends you a contribution.

3. Understand the fees associated with the crowdfunding site you choose.

These platforms are businesses in themselves. They don‘t let you host your projects, products, or services on their sites purely out of the kindness of their hearts — you’re going to have to kick a portion of the funds you raise up to them. You need to have a sense of how much you're going to pay if you reach your crowdfunding goals.

4. Choose multiple sites to appeal to diverse audiences.

Various crowdfunding sites have various kinds of investors with various needs, preferences, and degrees of purchasing power — so if you want to maximize your reach and potential to hit your funding goals, you might want to promote your offering on multiple platforms.

Casting a wide net can be one of the better ways to ensure your product, service, or endeavor gets as much visibility as possible — so when you're considering what site to pick, understand that you might be best off promoting across multiple platforms.

5. Read the fine print to ensure you can meet the requirements to claim your funds.

Crowdfunding isn‘t particularly helpful if you can’t, well, get any funding. That's why you need to know the nitty-gritty when you decide to promote your organization on one of these platforms.

Make sure you know what you're getting into with your platform of choice and what constitutes a “successful” project on the site — and be realistic about whether you can hit the required milestones within the timeframe specified on the site.

If you don‘t think you can meet a platform’s benchmarks, you'll probably want to reconsider promoting your organization, offering, or endeavor on it.

We asked entrepreneurs who ran successful crowdfunding campaigns: “What worked well for you, and what tips can you offer?”

1. Roxie Lubanovic, Co-Founder of Frostbeard Studio, says, “Leverage niche markets and community.”

"I co-founded Frostbeard Studio, the first business to specialize in candle scents for book lovers, and we‘ve had significant success in growing our business both online and in retail shops. While we didn’t run a crowdfunding campaign specifically, the strategies we used to ramp up our engagement and grow our customer base can be applied to crowdfunding efforts.

"One strategy that worked well for us was leveraging our niche market effectively. By focusing on book lovers, we created products that deeply resonated with a specific audience. Our “Book Lovers’ Soy Candles” became the best-selling candle business on Etsy in 2014. This taught me the importance of understanding your target market and tailoring your campaign to meet their interests and needs.

"Another key element was collaboration and community engagement. Back in 2008, I started a local artist and farmers market, which honed my skills in creating community-driven events. Sponsoring events and donating products to local charities and non-profits significantly increased our brand visibility. For anyone running a crowdfunding campaign, building a community around your product is crucial. Engage with local events, offer samples, and create a buzz around what you're offering.

“Lastly, clear and consistent communication is vital. When we launched our own website in 2015, we ensured that our branding, messaging, and visuals were all cohesive and appealing. This consistency built trust with our customers. For a crowdfunding campaign, this means having a clear project outline, regular updates, and professional visuals. Show your backers that you have a solid plan and the capability to deliver on your promises.”

2. Sahil Kakkar, CEO of RankWatch, says, “Offer tangible rewards and sell passionately.”

"When we launched RankWatch, a platform designed to enhance SEO strategies, crowdfunding was crucial for our initial financing. Our product, an innovative tool for real-time SEO monitoring and adjustments, resonated well with tech enthusiasts and marketing professionals, who constituted our main backer base. We focused heavily on transparent communication and regular updates about the development process, which helped build trust and maintain interest.

"The most effective strategy was offering tangible rewards aligned with our product's future usage, such as early access and discounted subscriptions. For those looking to run their crowdfunding campaigns, my tip is to ensure your rewards are enticing and directly related to your product or service.

“Additionally, leverage every possible channel to share your story passionately and authentically. Engaging potential backers emotionally can significantly boost your campaign's success. Keep your campaign message clear, concise, and compelling to maintain momentum and interest throughout your crowdfunding journey.”

3. Adam Garcia, Founder of The Stock Dork, says, “Highlight personal success stories.”

"Running a successful crowdfunding campaign taught me the value of storytelling. Our product, a smart budgeting app, resonated with backers because we highlighted personal success stories and demonstrated tangible benefits.

“For others venturing into crowdfunding, focus on building a genuine connection with your audience and providing clear, compelling reasons why your product matters. Authenticity and a well-crafted narrative can make all the difference.”

4. Alari Aho, CEO of Toggl, says, “Build community and foster trust.”

"Authentic storytelling played a pivotal role in our crowdfunding success. We crafted a compelling narrative around the problem our product aimed to solve, highlighting the real-life struggles and aspirations of our target audience. By connecting emotionally with our backers and sharing our journey transparently, we fostered a sense of community and trust, motivating supporters to rally behind our campaign and spread the word to their networks.

"Our product was Toggl Plan, a visual project management tool designed to streamline collaboration and increase productivity for teams of all sizes. With intuitive drag-and-drop functionality and customizable timelines, Toggl Plan empowers users to plan, track, and manage projects with ease, allowing teams to stay organized and focused on achieving their goals.

"Prioritize building a community around your product before launching your campaign. Engage with potential backers early on through social media, forums, and events, soliciting feedback and involving them in the product development process. By cultivating a loyal following and establishing credibility within your niche, you'll have a ready-made audience eager to support your crowdfunding campaign when the time comes.

“Additionally, don't underestimate the power of authenticity and transparency. Be honest about the challenges and risks involved in bringing your product to market, and demonstrate your commitment to delivering value to backers. By fostering trust and credibility, you'll not only attract more backers but also build long-lasting relationships that extend beyond the campaign.”

5. Yoyao Hsueh, Founder of Topical Maps says, “Create pre-launch buzz and engage visually.”

"Running a crowdfunding campaign for an advanced topographical mapping tool, success came from creating a compelling narrative and engaging visuals. Building excitement through a pre-launch email list and social media buzz was crucial.

“My tip: Connect emotionally with your audience, show them the problem your product solves, and maintain transparency throughout the campaign. Authenticity builds trust and drives support.”

6. Niclas Schlopsna, CEO of spectup says, “Craft a compelling product narrative.”

"One memorable crowdfunding success story from our work at SpectUp involved helping a client, Emma, launch a unique, eco-friendly travel backpack. Emma's product stood out due to its sustainable materials and innovative design features tailored for modern travelers. The key to her successful campaign was a combination of meticulous planning, compelling storytelling, and community engagement.

"We started by helping Emma craft a captivating narrative that highlighted not just the features of the backpack, but the story behind its creation and the environmental impact it aimed to address. This narrative was crucial in connecting emotionally with potential backers. High-quality visuals and a professional video further showcased the backpack's unique qualities and versatility, making it visually appealing.

"Another crucial element was building a community before the launch. Emma engaged with potential backers through social media, sharing sneak peeks and gathering feedback. This not only created buzz but also fostered a sense of ownership among early supporters. When the campaign went live, these engaged followers were ready to contribute and spread the word.

“Specific tips for others looking to run successful crowdfunding campaigns include starting with a strong, relatable story; investing in professional visuals; and actively engaging with your target audience well before the campaign launch. Setting realistic funding goals and offering attractive, meaningful rewards can also significantly boost your campaign's appeal.”

Ultimately, crowdfunding is a viable option for a lot of entrepreneurs looking to raise capital. It's a relatively accessible, effective option for several businesses that might not have the prominence or resources required to garner investments conventionally.

That said, hitting your fundraising goals via crowdsourcing isn‘t some magic bullet — so if you decide to leverage one of these platforms, be sure to set feasible goals, thoroughly understand the service you go with, and work to cultivate the buzz you’ll need to succeed.

Editor's note: This post was originally published in June 2019 and has been updated for comprehensiveness.

Entrepreneurship Trends Report

Unlock the future of entrepreneurship with this free report from HubSpot and The Hustle.

- 92% of entrepreneurs have no regrets about starting their business.

- 61% find customers through powerful word-of-mouth referrals.

- 37% of entrepreneurs are targeting higher ARR in the next year.

- And more trends!

Download Free

All fields are required.

![What I’ve Learned About Selling Online Courses (and How You Can Too) [+ Expert Insight]](https://53.fs1.hubspotusercontent-na1.net/hubfs/53/sell-webinar%20%281%29.jpg)

![What is a Silent Partner? [+How to Find One For Your Business]](https://knowledge.hubspot.com/hubfs/silent-investor-1-20250124-8605371.webp)

![Debt-to-Equity Ratio, Demystified [+Helpful Formulas]](https://knowledge.hubspot.com/hubfs/debt-to-equity-1-20250115-1477462.webp)