As an entrepreneur, it’s essential to keep your current assets high if you want to keep your business running at a steady pace.

Whether you need new equipment for your business or a larger office space, you need cash for a variety of expenses. To get this cash, you have a few options. You can tap into your checking account, raise funds, or even take out a business line of credit. Or, you can rely on current assets to pay for these investments.

Let’s go over what exactly current assets are and examples of this important business accounting term.

Table of Contents

- What is a current asset?

- What can you do with current assets?

- Types of Current Assets

- Examples of Current Assets

What is a current asset?

Current assets are cash and short-term assets that can be quickly converted to cash within one year or operating cycle. They're also referred to as liquid assets. When an asset is liquid, it can be converted to cash in a short timeframe.

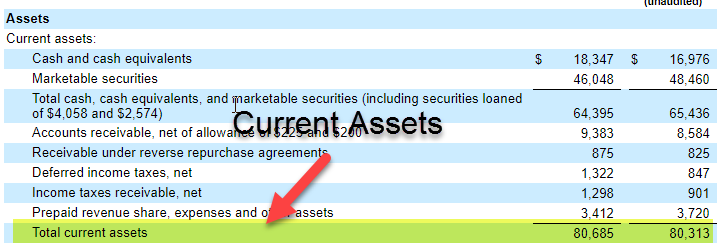

Below is a list of current assets often listed on a company's balance sheet:

- Cash.

- Cash equivalents.

- Accounts receivable.

- Inventory.

- Prepaid expenses and liabilities.

- Short-term, liquid investments.

Current assets will turn into cash within a year from the date displayed at the top of the balance sheet. A balance sheet is a financial statement that shows a business‘ assets and how they’re financed, through debt or equity.

The balance sheet reports on an accounting period, which is typically a 12-month timeframe. Current assets can be found at the top of a company‘s balance sheet, and they’re listed in order of liquidity.

Non-current assets (or fixed assets) are long-term investments that often cannot be turned into cash within a year. Examples of non-current assets include real estate, land, equipment, intangible assets, trademarks, copyrights, and patents.

If you need a quick way to remember what's considered non-current, think property, plant, equipment, and intangible assets. Assets that fall within these four categories often cannot be sold within a year and turned into cash quickly.

What can you do with current assets?

Keeping current assets high is important if you want to run a healthy business. Current assets can fund day-to-day operations or short-term expenses that keep your business running. Some things you may use current assets to pay for include:

- Day-to-day operations (inventory, employees, etc.).

- Business investments (equipment upgrades, new office, etc.).

- Debt payments (bills, loan payments, etc.).

Next, let's take a deeper look into different types of assets in order of liquidity.

Types of Current Assets

Understanding what types of assets you have will give you a clearer idea of which ones can be converted to cash to fund your business endeavors.

Cash

Cash is the primary current asset, and it‘s listed first on the balance sheet because it’s the most liquid. It includes domestic and foreign currency, a business checking account that's used to pay expenses and receive payments from customers, and any other cash on hand.

It also includes imprest accounts which are used for petty cash transactions. This cash is used for small payments like donuts and coffee for a morning meeting, reimbursing an employee for a minor business-related expense, or purchasing a low-cost supply, like paperclips or stamps.

Cash Equivalents

Cash equivalents are nearly as liquid as cash. These are considered liquid assets because they can quickly be converted into cash when needed. Cash equivalent assets include marketable securities, short-term government bonds, treasury bills, and money market funds.

Accounts Receivable

Accounts receivable are the money customers owe the seller or business. Since most customer payments are converted to cash within a year, it's listed as a current asset. For example, a furniture company designs a couch for a customer with the agreement that the customer will be billed once the couch is delivered. The payment owed can be recorded under accounts receivable.

If a good or service takes over a year to convert to cash, it would be considered a long-term asset and wouldn't be reported under current assets. Instead, it would be classified as a non-current asset.

Inventory

Your business' raw materials and any unsold merchandise are known as inventory. These items are considered liquid because the merchandise is often sold within a year. Inventory is a current asset that needs to be monitored closely.

If you have too much inventory, your items could become obsolete and expire (e.g., food items). You‘ll spend too much money on manufacturing and storing the merchandise. And if you’re short on inventory, you‘ll lose sales and likely have frustrated customers who can’t purchase your product because it's out of stock.

Examples of Current Assets

Now that we better understand the different types of current assets available, here are a few examples of current assets and how they can be used to fund your business.

Short-term Investments

Short-term investments are cash equivalents that are considered liquid assets. Cash equivalent assets include stocks, bonds, savings accounts, and mutual funds.

Prepaid Expenses

Prepaid insurance is recorded as a current asset on the balance sheet. It's the term used to describe advance payments for insurance coverage. Insurance premiums are often paid before the period covered by the payment. And the entire amount is typically paid off within a year.

Rent can also be considered a current asset. If you‘re making a rent payment before the period it’s due, this is considered prepaid rent. It‘s a current asset that’s reported on the balance sheet.

The payment is considered a current asset until your business begins using the office space or facility in the period the payment was for. For example, a business pays its office rent for November on October 30th. Once they begin using the office space on November 1st, the payment would then be reported as an expense.

Equipment

It's important to note here that equipment is not considered a current asset because it's a fixed, long-term asset.

Equipment includes machinery used for operations and office equipment (e.g., fax machines, printers, copiers, and computers). These are fixed assets, as they're used long-term, and their usage period is typically longer than one year.

Managing Your Current Assets

Current assets are essential for any healthy business. Whether you work with an accountant or have an internal team run your numbers, every business balance sheet must track current assets.

![How to Write a Business Proposal [Examples + Template]](https://www.hubspot.com/hubfs/how-to-write-business-proposal%20%281%29.webp)

![The Straightforward Guide to Value Chain Analysis [+ Templates]](https://www.hubspot.com/hubfs/ft-value-chain-analysis.webp)

![How to Start a Business: A Startup Guide for Entrepreneurs [Template]](https://www.hubspot.com/hubfs/How-to-Start-a-Business-Aug-11-2023-10-39-02-4844-PM.jpg)