One of the most dangerous threats to companies in the subscription economy is the challenge of simply getting everyone to focus on the customer. The stakes are high, and the failure to aggressively align the entire organization to the customer costs companies dearly.

Too often, leaders watch in frustration as their teams work disjointedly to plug the wrong holes, while churn rises, sales decelerate, and growth collapses. This is the beginning of the dreaded "Death Spiral" which is the inevitable outcome of the failure to become truly customer-centric.

I'm going to tell you why I think it's so hard to figure this out, and along the way, I'll share stories and new data that shed fresh light on the challenge. Most importantly, I'm going to give you the simple process that I use with my clients to cut straight to the heart of what makes their customers successful. Following this process produces a "Customer Bullseye" that can align everyone's efforts to crush churn and reignite growth. It all starts with asking the right questions.

I've found that often the key to success is to get a clear view of the opportunity by asking the right questions. We rarely articulate and examine our questions as we work. But they are there nonetheless, implicitly framing everything we do. And getting them right is essential.

It's impossible to get the right answer if you are asking the wrong questions.

Too often we are working away at something with little to show for it. I think that most of the time what is underneath these frustrations are faulty questions. I believe that is exactly what has happened in the case of growth and customer success.

The Questions Preventing You from Adopting a Customer-Centric Strategy

In the subscription economy, there are two basic questions underlying how we think about growth:

- Why do customers buy?

- Why do customers leave?

We rarely articulate these questions, but they are there just the same, framing virtually everything we do in business. We expect that solving for these two questions will naturally lead to the accumulation of customers and drive growth. It makes perfect sense: bring more customers in and reduce the number that leave, and you get growth.

But it's a trap.

These are actually the wrong questions, and solving for them ultimately leads to rising customer churn, falling sales, and stagnating growth. Let's look at each of these questions to see why they get us in trouble.

Wrong Question 1: Why Do Customers Buy?

This first question -- Why do customers buy? -- is the foundation for everything that sales and marketing do. That is the definition of their job, and we aggressively reward them when they do it successfully.

What's Wrong With This Question?

The problem is that there's a huge flaw in this question: Not every reason to buy is equally valid.

Think about your own company: there are probably a variety of reasons why customers join. Invariably some of those reasons turn out to be really compelling and those customers tend to get good results and stay for a long time, while other reasons don't play out as well.

But wait, isn't any reason to buy valid as long as its valid to the customer? Who are we to judge their reasons to buy?

Absolutely, and this is actually the heart of the matter. A recent experience illustrates why:

The Case of the Disappearing Customers

A SaaS company came to me recently with a puzzling situation. They had a large number of customers leaving within the first year even though these specific customers were reporting very high satisfaction with the service.

The company had heard me talk about how customer happiness is not the solution to customer success, and so they thought I might be able to help them with their dilemma. I dived in and quickly discovered that one of the reasons some customers were signing-up is to meet a temporary need. These are actually successful customers that simply no longer need the service after the first several months.

Looking more deeply, I found that many of these customers also have a longer-term need for the solution. But the sales executives have learned that it is easier and faster to win customers for the temporary need. In this case, fewer conversations and no long-term commitment translate into a more efficient sales process.

The problem, in this case, is that this particular reason to buy is not also a good reason to renew. This is a really big issue since most companies don't make money unless customers stay for a long time. And even if these short-term customers are profitable, the value of the entire enterprise is severely diminished by high customer churn rates. That's why just selling as many new customers as possible can never be the right strategy in the subscription economy.

It's not enough to get customers to join, they have to join for the right reasons.

Bad Reasons To Buy

Meeting a temporary need is just one example of many bad reasons to buy. Other examples include:

- Buying for the wrong benefits (bad fit)

- Buying with the wrong expectations (overselling, underselling)

- Buying features rather than benefits (demo selling)

- Buying to "try it out" (free trials, opt-outs)

- Buying for a single feature (selling against competitors)

- Buying on a whim or emotion (relationship selling, convention selling)

- Buying to use up available budget (last-minute selling)

- Buying the lowest-cost option (discounting)

These reasons and many more demonstrate a simple truth: not all reasons to buy are equally valid if they are not also reasons to stay.

Think about this from your own experience:

- Have you noticed that some reasons to buy are more durable or successful than others, particularly over the long run?

- Are you aware of particular sales behaviors, pitches, or promises that lead to higher churn?

In my experience working with many different companies, this has been a consistent theme. In fact, I've come to the conclusion that this is the most significant factor driving long-term customer churn in many companies.

What Does the Data Say?

I'm the kind of person who likes to validate intuitions using hard data. My reason is simple: over many years I've found that our intuitions frequently turn out to be wrong. That's why I've been gathering data on customer success outcomes from dozens of SaaS companies over the past few years. It's a very unique set of data that has grown to over 75k data points and continues to expand.

The question I wanted to ask the data was simple: is there evidence that some reasons to buy are consistently better than others for customer outcomes? The short answer is yes. There are actually many indicators, but I will share just two examples here.

1. Sales retention superstars are key.

First, it is well known in the world of sales that a very small number of reps are consistently the highest performers by a wide margin. I wanted to know if this holds true when you measure sales reps by how well their accounts retain. In other words, do accounts sold by particular reps consistently renew at higher levels? My hypothesis is that this would be a clear indicator that the way in which an account is sold matters for success.

The results strongly confirm the hypothesis. There is consistently a very large difference between the reps with the highest retention performance, and everyone else. And these results are consistent across many companies, as well as being stable over time, and across customer segments. This means that there must be meaningful differences in the way accounts are sold that matter to customer retention over the long run.

To understand these differences better, I've spent time studying many of these reps closely. Suffice it to say that they do in fact sell differently and in ways that are consequential to long-term customer success. But that's a subject for another article.

2. All reasons are not created equal.

A second proof point from the data came out of a large study in which all customers were grouped by the primary reason they purchased. The results are astonishing and definitive. Some reasons to buy are clearly much better than others in the long run.

When I saw this data, it blew my mind. It confirmed everything I had experienced for years. It also shows clearly that the best and most meaningful way to segment our customers isn't by their size or industry, but by their reason to buy.

It's a powerful reminder that in the subscription business model, the act of "closing" a new customer - while important - is not success. All we've done at that point is introduce that customer into the "mall". Everything we ultimately earn from that customer will come from keeping them in the "mall" and selling them more.

Your churn rates and losses are going to continue rising until you acknowledge and adapt to this truth:

Not all reasons customers buy are equally valid reasons to stay. How we sell, and who we sell to, have a bigger impact on customer outcomes than anything else we do.

Wrong Question 2: Why Do Customers Leave?

Now let's turn our attention to the second wrong question: Why do customers leave? Like the previous question, this also seems completely reasonable and useful. It's the underlying logic of virtually everything we do in customer success. But once again, it's a trap. Let me explain…

What's Wrong With This Question?

I'm sure many of you have probably had a similar experience to one that I've had many times. In an effort to reduce churn, we go out and survey our canceled customers and ask them why they left. We gather up all those results, organize them into categories, and put them into a pie chart. Then we pick the one or two biggest reasons and go to work solving those issues. With great effort, we crush those issues down and look forward to improved retention. But what actually happens to churn? Usually not much! Certainly not in proportion to the slices of our pie. But why?

I've personally made this mistake over and over again, and it has taken me a very long time to start to understand why this simply doesn't work. I call it "studying failure" and it's the reason that I don't do exit analyses anymore. I'm convinced asking customers why they are leaving is a dead end.

One hint that there's something wrong with the logic of this approach is that it raises a question: Why aren't the other customers leaving? Certainly, many of the customers who are renewing have also experienced the same issues as those that have canceled. In fact, it's typical for our most successful customers to be using the solution even more deeply and therefore they tend to run into more problems rather than fewer. So why don't they leave? Obviously, there's something else going on here.

Think about your own experience:

- Have you had a customer leave but on the way out, say very nice things about you or the company and how happy they were with the experience?

- Conversely, do you have a customer who is unhappy and complaining, but keeps renewing?

What gives? Clearly, problems with the solution and bad experiences aren't the only factors driving churn.

What Does the Data Say?

Naturally, I wanted to know whether this was reflected in the customer retention data. Actually, there are many indicators of this in the data, and here I will share two that demonstrate the point.

1. Customers that complain are actually more likely to renew.

The first data point may initially seem counterintuitive. The data consistently show that customers who complain are actually more likely on average to renew than those who don't. When you divide customers into groups, the group that submits tickets consistently retains at a higher rate on average than the group that doesn't.

But how could this be true? We believe that making customers happy and providing a good customer experience is the key to long-term success. We would reasonably expect that more problems would lead directly to more churn.

But this is dead wrong. As I've argued for years, satisfaction is not the primary driver of long-term retention, and customer issues are not, on their own, indicators of account risk.

The intuition is simple: Think about what a customer is signaling when they complain. When they run into issues and go through the trouble to complain or open a ticket it is a clear signal that the solution matters to them and that they are engaged with it in a meaningful way.

2. No signal is the worst signal.

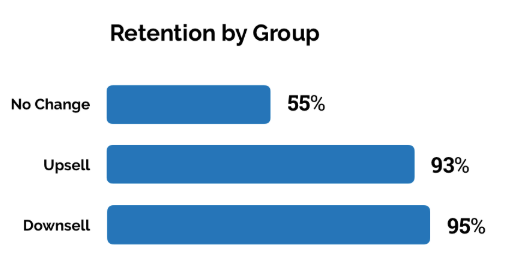

The second validation of this comes from a large study in which we divided customers into groups based on whether they had ever requested a change in their contract - either expansion (upsell) or reduction (downsell). The hypothesis was that these requests signal whether the solution is important to the customer.

The results confirm the hypothesis and even offer a bit of a surprise. The group we naturally think of as healthy are those who don't bother us. But this shows that they are the most at risk for churn.

The next result makes a lot of sense: customers that request an expansion are very likely to retain. It's an intuitive result: requesting more of the solution is a clear signal that it matters to them.

So what about those that are asking for a reduction? This seems to be a negative signal that the account is at risk. Wrong! Actually, this group has a two-year retention rate that is the highest of all! But how do we make sense out of this? Again, think about what they are signaling when they ask for a reduction. They are certainly not communicating that the solution is irrelevant to them. In many cases, they've established a valid long-term use case, and now they are optimizing it to fit.

Please understand, I'm not suggesting that we don't need to improve our solutions and solve the real issues our customers experience. Of course, we should do everything we can to remove friction from the customer experience, and shame on us if we don't. But it clearly won't be enough to get us the results we are striving for.

So here's my rule for this ...

Customers don't leave because they have a reason to leave. Customers leave when they no longer have a compelling reason to stay.

Now that we know why these two questions are problematic, we can turn our attention to the search for better questions that will reliably guide us to the right set of answers.

The Right Question: Why Do Customers Stay?

I believe that there is actually just one ultimate question at the heart of success in the subscription economy. It's not about why customers join, or why customers leave, but why they stay.

This is a much better starting point. It avoids the pitfalls inherent in the wrong questions and provides absolute clarity for what it means to have a customer-centric business strategy.

One particular experience changed my thinking on this.

For many years I managed a very large customer that was notoriously demanding, and virtually impossible to satisfy. They were always unhappy with us, and constantly complaining about our solution and demanding changes. Dealing with them was actually rather unpleasant! (I'm sure many of you can relate to this experience!)

This went on for a few years, and at one point my frustration got the better of me. Right in the middle of a meeting, I asked them, "If you are so unhappy, then why don't you just cancel?" The customer was somewhat confused by my question and responded, "Why would we cancel when you make us so much money?" I immediately felt embarrassed. After all, why did I ever think it was about anything else?

That was a profound lesson for me. There are always plenty of reasons to cancel. None of our products are perfect. Every product has friction and issues, and customers can always find reasons to be unhappy. But as I've been saying for years: happiness is not the panacea of customer success!

Figuring Out Customers' Reasons to Stay

When we sincerely begin to seek the answer to this question -- Why do customers stay? -- it will lead to powerful new understanding that can finally align us with our customers, and guide all the company's efforts to drive sustainable growth.

So, what's the answer? Why do customers stay?

The answer will obviously be different depending on your product and market. But whatever you do, and regardless of what your customers are looking for, on this point the data are compelling: the customers who stay are those that succeed. Customers that produce measurable and durable results stay more than four times longer.

So here's my rule:

The only valid reasons to buy are those which are also reasons to stay. The reasons to stay are always those that produce measurable and durable results.

Studying Success When it Comes to Customer Centricity

The key to building an extremely high-growth customer engine is to identify the reasons your customers stay and use that clarity to get every part of your organization to focus its efforts on driving this dynamic:

- Marketing must focus its messaging and campaigns to attract and cultivate the leads with the right reasons to stay.

- Sales will craft customer deals aimed at the right benefits: those with the ability to drive measurable results over the long term.

- Customer Success can use its limited time and resources to help customers change how they work in key ways to achieve measurable results, and keep expanding them.

- Product will be able to envision the improvements that will drive the essential customer results, and the clarity to properly prioritize the roadmap.

So, the task is clear. You must discover with more clarity than ever before precisely why your customers stay. Be prepared for some in the organization to think that they already know why your customers stay and that such an effort is unnecessary. But it's just as certain that there is disagreement within the company about what matters most. Remember that this is something that can only be properly understood from the customer's perspective. And, make no mistake, the negative information that tends to accumulate from customer interactions cannot be trusted as a clear signal regarding the essence of why your most successful customers stay.

I have developed a simple process that I use with my clients to clarify precisely why their successful customers stay. It's a process you can follow, and I'll provide a brief overview here. For those who are interested in doing this in your own company, I have posted my detailed, step-by-step guide including templates and forms for you to use. You can access it here.

The purpose of the Success Analysis is to answer the key question: Why do customers stay? This process will help you identify your most successful customers, conduct effective interviews, and create your Customer Bullseye.

Step 1. Identify your most successful customers.

The first step is to select the right customers to interview. The goal is to interview at least 5 customers, so you probably should identify at least 10 in order to account for the possibility that some customers may not be available. When you have your list, reach out to the customers to try to get at least five interviews scheduled. If you need help, you can use my simple email script (available here).

Identifying your happiest customers may seem like a simple matter. However, it is important to understand there is a difference between a successful customer and one that is "happy" or says nice things about you. Successful customers are those that have achieved significant results of the kind your solution promises, and are able to speak to how those results were achieved.

Step 2. Interview Them To Learn Why They Stay

The next step is to interview each customer to get to the heart of why they stay. You will be looking to answer three key questions:

- Why did the customer buy the solution in the first place?

- How successful has it been?

- What has the customer done to make it successful?

It will likely take multiple questions to get complete answers. To help you, I've posted my specific interview question guide (available here) which I developed from conducting hundreds of these interviews.

These interviews can normally be completed in 45 minutes, and it's best to include the CSM or Account Manager to schedule the interview and introduce the interviewer to the client. My detailed interview agenda and plan is available here.

Step 3. Distill The Learnings Into Your Customer Bullseye

With your interviews complete, you are ready to distill the results into your Customer Bullseye. There are four key elements of a Bullseye Customer:

- What is their primary business objective?

- How do they measure success?

- What are their key attributes that enable these customers to succeed?

- What key processes are essential to their success?

The Bullseye Customer document is a one-page summary where you succinctly answer each of these questions (or use my template available here). Brevity and clarity are essential. Unless you can identify the one most important answer to each question above, your work is incomplete and the outcome will simply lead to further dissipation and misalignment.

Therefore, a significant amount of judgment must be invested. The most important things will always be those that form an intersection between producing measurable results (as opposed to unmeasurable) which are mission-critical to the customer's business, and that are common across the majority of successful customers.

What's Next?

The Customer Bullseye will become the anchor point for guiding all customer activities. Start by examining your direct customer interactions in light of what you've learned. Identify opportunities to focus more precisely on the factors that drive their success. Where are you spending time and effort that is not precisely aligned with the Bullseye benefits, and key customer processes? Look for opportunities to replace low-leverage activities with those that drive directly to the Bullseye.

Pay close attention to your onboarding process in particular. Are all activities targeted at driving the benefits identified by your customers that stay? Are you using valuable customer time merely to configure and train? Use the Bullseye to identify the activities that have the highest leverage for driving their success. Look for ways to simplify configuration through standardization, and move training to videos or webinars. This will free up precious resources to focus on helping the customer change how they work to drive their outcomes. Make sure every touchpoint is aligned to the bullseye benefits.

The ultimate goal is to align the entire organization to the Customer Bullseye. You should share it with other departments and help them identify ways to incorporate key elements into their activities. The best way to start is by working across functions to answer a few key questions:

- Marketing: How does the Customer Bullseye impact the marketing strategy, what the key message should be, and the kinds of customers to target?

- Sales: What are the best reasons to buy, and how can we guide customers to give them the best chance for long-term success? What should we eliminate from our practices that jeopardize long-term customer outcomes?

- Onboarding: How does the Customer Bullseye change the focus of the onboarding process? What are the most important things we can do to ensure customers achieve success?

- Renewal: What key milestones are necessary for customers to have a compelling reason to stay? Working back from the optimal renewal outcome, what are the specific things that must happen and when?

- Product: How does the Customer Bullseye clarify the product roadmap? What innovations or improvements will directly drive better, and more measurable, customer results?

The Customer Bullseye is the starting point on the journey to true customer-centricity. With it, you are able to establish a common set of objectives across departments, and align everyone to focus on driving the most important customer benefits.

To learn more, read our list of steps for becoming a more customer-centric organization next.

![How To Write a CSM Resume [+ Free Templates]](https://www.hubspot.com/hubfs/customer-success-manager-resume-1-20241031-2293336.webp)