If you’ve ever checked the cost of an Uber and noticed a surge a few minutes later, you’ve experienced dynamic pricing. This pricing structure has been the norm since the 1980s, especially in the hospitality and travel space.

Dynamic pricing seeks to maximize profit by changing the price at times of peak usage. If the demand for a product or service goes up, so does the price. In this post, you’ll learn more about building a dynamic pricing strategy, as well as its pros and cons.

This post explores:

- What is dynamic pricing?

- Types of Dynamic Pricing

- Dynamic Pricing Examples

- Pros of Dynamic Pricing

- Cons of Dynamic Pricing

- How to Implement Dynamic Pricing

- Dynamic Pricing Outcomes

What is dynamic pricing?

Dynamic pricing — also known as surge pricing, demand pricing, or time-based pricing — is a strategy where businesses adjust the prices of their offerings to account for changing demand. For instance, an airline will shift seat prices based on seat type, number of remaining seats, and time until the flight.

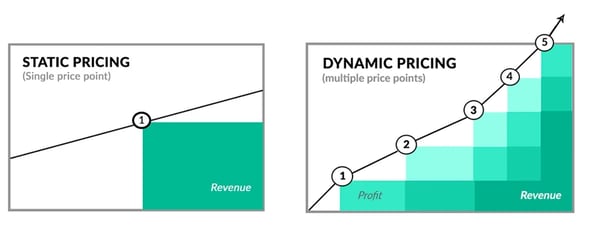

Here's a visual of how dynamic pricing works:

Opposed to static pricing, dynamic pricing helps your business maximize profit by operating at multiple price points.

However, this strategy isn’t for everyone. For instance, restaurants use static pricing, regardless of how many customers are seated. Many manufacturers do the same.

To determine if the dynamic pricing model suits your business, consider these questions.

- Can your business gauge how and when demand shifts? If your company has no reference points for understanding how its market fluctuates, it won't be able to effectively adjust prices to suit changing demand.

- Will your customers be okay with non-static prices? Your company can't successfully use dynamic pricing if potential consumers are reluctant to pay extra. This strategy is even more difficult if your industry has established pricing structures. Your consumers could churn if you increase your prices while your competitors don’t.

- Is your company a market leader? An organization can only set prices at will if it has a significant place in its market. If a relatively small business in a crowded industry raises prices on a whim, customers could easily switch to a competitor.

- Do your industry peers use dynamic pricing? Using dynamic pricing is an excellent idea if it’s common in your industry. This makes sense because your competitors have already validated that dynamic pricing works.

Types of Dynamic Pricing

Time-based Pricing

The time-based pricing occurs when a surge or reduction in demand is linked to a particular time. Businesses also use this strategy to entice customers to make quick purchasing decisions.

Some examples of time-based pricing include:

- Paying extra for products to get same-day delivery.

- Surge Lyft prices during rush hour.

- Booking airline tickets months in advance, which costs less.

- Promoting limited-time offers so customers can make quick purchasing decisions.

Segmented Pricing

Segmented pricing is a model where you establish two or more prices for the same product. This pricing is ideal for audience segments that perceive your product’s value differently.

Business class versus economy plane tickets offer a classic example of segmented pricing. Another example is sports tickets. Here, prices depend on the appeal of the teams playing, the athletes involved, the seat positions, and more.

When exploring segmented pricing, consider the following:

- Your customer demographics. Are certain personas more likely to purchase your product?

- Location. Will the location of your business or customer affect how much you can charge?

- The type of product (physical or digital). For example, customers may be willing to pay more for a physical board game than a digital version.

Peak Pricing

Transportation and hospitality companies often use peak pricing. If demand increases during a certain month or season, prices increase.

For instance, if you’re looking to stay in the Coachella Valley, expect a price increase during the height of music festival season. Plane tickets offer another case study. For example, airfare goes up during the holidays. In 2022, airfare costs jumped 20% during Labor Day weekend.

Now, let’s explore more examples by industry.

Dynamic Pricing Examples

Hotels

Hotels adjust the price of rooms based on factors like availability and seasonality.

For example, a hotel room in Northern New England will likely be more expensive during the fall. Why? Tourists will be more interested in seeing leaves change. They’ll prefer this over the dead of winter when the area sees snow and local attractions close.

Utility Providers

Utility providers like gas and electric companies often leverage dynamic pricing — typically, in response to seasonal shifts. For instance, during summer, there's a reduced need for indoor heating, so the price of electricity tends to fall.

In some areas, prices may change throughout the day. Right after work, the electricity costs to run a load of laundry may go up, as more people are using the electric grid.

Google Ads

The cost of running Google ads varies by the popularity of an ad’s keyword. For example, a business that runs an ad targeting “mesothelioma lawyer” will pay $473.19 for each click.

Whereas, the keyword “family lawyer” costs $20.93 for each click. This shows that law firms compete more for “mesothelioma lawyer” than for “family lawyer,” causing Google to vary the price of both keywords.

Pros of Dynamic Pricing

You can pay employees a higher wage during busier times.

Dynamic pricing can give you the flexibility to reward your employees during busier stretches. By adjusting prices to suit heightened demand, you can raise more funds and increase wages.

You can still sell in downtimes.

Sales are usually poor in times of low demand. But with dynamic pricing, you can salvage some business. How? By lowering prices to suit lower demand.

Offering sales and discounts can help you appeal to a broader base of consumers who aren't willing to pay full price. Plus, these new customers could patronize you long after demand returns to normal.

Cons of Dynamic Pricing

Customers might feel cheated and trust you less.

Inconsistent pricing might get on your customers’ nerves, frustrate them, and make them try a competitor’s product. If consumers see a fair price for your product or service today — only to have it radically shift the next day — they might feel you're being too opportunistic or flat-out unfair.

If you overdo it, you might lose business.

Overdoing dynamic pricing — specifically, excessively hiking prices during times of peak demand — could make you lose some customers and reduce your returns. Once the dust settles and your price stabilizes, you might have annoyed your base enough to miss out on their business in the future.

How to Implement Dynamic Pricing

When exploring dynamic pricing, start by determining if this model works best for you. Then, craft a plan to implement this new strategy. These four steps will help you make the right decision.

1. Determine your commercial objective.

Identifying your commercial objective is the first step in implementing a successful dynamic pricing strategy. Think of your objective as a compass that directs the decision-making process of your company.

Consider the following:

- Why do we exist as a company?

- What are our customers’ expectations?

- Do we want an increased volume of sales versus overall profit?

- What is our current pricing model?

- What are the perks and drawbacks of our current model?

2. Choose a pricing strategy.

Once you identify your commercial objective, you can find a pricing strategy that complements your goals.

For instance, if your goal is to increase the amount of product you sell, increasing prices during the holiday season may lead to decrease revenue. Static pricing may be the best fit.

However, if you’re creating a ridesharing service to help parents pick up their kids, dynamic pricing may work best. Prices can go up after the school day is over. While there may be the occasional extra-curricular activity that requires pickup, prices can go back down later in the evening.

3. Establish your pricing rules.

While the prices of your products may change, the rules you use to set prices should stay consistent. Will prices go down if a product underperforms? What times of the day or months of the year affect your pricing? What algorithms or formulas are used to determine the percentage increase?

For instance, if an e-commerce store is going out of stock, it can set a rule to follow the lowest price range of some competitors when the stock reaches a certain number.

You’ll also have to decide which of your offerings will be affected by the switch to dynamic pricing. Will every service fluctuate, or will only a few offerings adopt this new pricing model?

4. Find the right tools to implement your strategy.

There are lots of dynamic pricing tools that can help you enact your new strategy. Some tools are specific to certain industries. Here are a few popular options:

These tools allow you to select which products are affected by dynamic pricing. You’ll also be able to set the pricing rules for these offerings.

Once the tool has been implemented, be sure to test and monitor your strategy. The data you gather can shape your future pricing decisions.

Dynamic Pricing Outcomes

Dynamic pricing is a delicate practice that only works in certain circumstances. That being said, it's worth having an understanding of the concept. If your business meets the required elements to leverage it freely, you absolutely need to have a grasp on it. When done right, your strategy should grow your revenue, profitability, and margin performance.

Regardless of what pricing method you choose, HubSpot’s free pricing strategy calculator and template can help you succeed.

![Price Skimming: All You Need To Know [+ Pricing Calculator]](https://53.fs1.hubspotusercontent-na1.net/hubfs/53/price-skimming-strategy.jpg)

![B2B Pricing Models & Strategies [+ Pros and Cons of Each]](https://www.hubspot.com/hubfs/b2b-pricing-models-and-strategies.jpg)