Isn't it funny how rapidly popular business terms come into vogue, and then serve as a big forehead "L" when their 15 minutes of fame have expired? Much as "big data" has been virtually retired, the moment is soon arriving when prescriptive analytics for B2B sales professionals will have wiped out the current rage around “predictive data.”

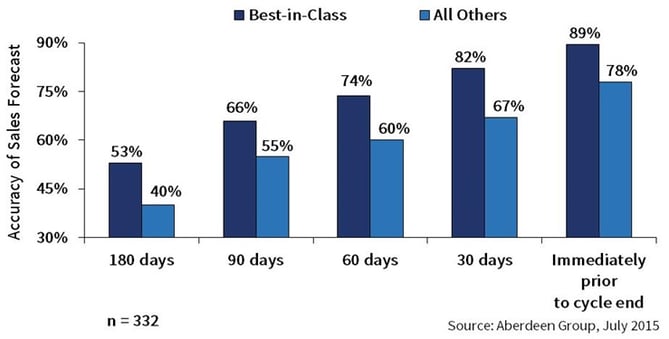

Once upon a time, Aberdeen's research looked at analytics from a perspective limited to how Best-in-Class companies generated more accurate sales forecasts. This research was actually quite valuable at the time. As other line of business leaders such as customer service, human resources, and supply chain VPs were being tasked with running leaner, just-in-time departments, their tolerance for wildly inaccurate sales forecasts fell to an all-time low. As a result, they began pressuring Sales Operations for a more realistic anticipation of the raw materials, hiring, logistics, and revenue that would soon be flowing through their individual domains.

In response, sales leaders began investing in (mostly cloud-based) solutions that amped up the rudimentary forecasting functionalities of CRM platforms, and learned to rely less on emotions, and more on facts in creating and weighting their forecasts. Predictably (pun intended) top-performing firms were early adopters, and their results evident.

Figure 1: Sales Forecast Accuracy, by Best-in-Class and Sales Cycle Window

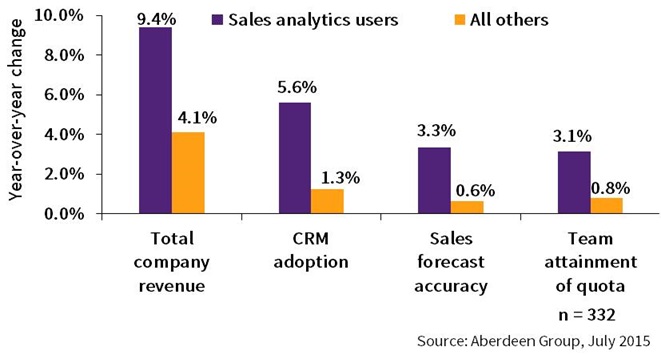

Moreover, the research revealed that companies deploying these solutions, and having predictable sales pipelines, achieved better business results around a variety of sales KPIs examined for year-to-year metrics changes.

Figure 2: Early Adoption of Sales Analytics Supports Annualized Performance Improvements

Most of these sales analytics engines relied on the significant processing power of what were once leading-edge "big data" and business intelligence products. These products analyzed enormous quantities of data to help sales leaders identify trends such as:

- Which products are more likely to be purchased by specific types of buyers?

- Can I use geographic, demographic, firmographic, and customer buying histories to better isolate which up-sell and cross-sell deals are most likely to close?

- How do we determine which deals are bad ones, i.e. more likely to end in no-decision or, worse, no-profit?

- Are there individual contributors, channel partners, regions, or sales teams who are more reliable in their forecasting?

Seeking to assist sales leaders -- mostly former successful reps who traditionally had not been the sort of people to spend the day buried in spreadsheets -- with new ways to crunch data, technology solution providers began revving up their algorithms to help produce systems of forecasting weighting. Designing easy-to-use interfaces and dashboards, these applications gave sales operations practitioners enhanced abilities to accept raw forecast data from the field (complete with whatever sandbagging or happy-ears emotion that suited the rep or channel partner), and more objectively spin the dials by relying increasingly on predictive data than on gut feelings.

Think Moneyball for sales, and the metaphor should make sense.

A Little Pavlov Never Hurt a Sales Team

Thus, predictive analytics grew quite competent in illuminating the challenges of B2B sales managers with data. And yet, it still only tells us things such as: who is better at forecasting deal probabilities, what opportunity will more likely close, when will the contract be returned, and perhaps, even at which specific margin the deal will be finalized.

But, if we seek closure around the common vocabulary of journalism -‒ the five Ws -‒ these platforms are not as strong as they should be around "why." As in, why did a sure-thing opportunity not come through? Was it something the rep said? Something they didn't do? Do we really need to wait for win/loss deal post-mortems to learn how to better influence sales outcomes?

These questions bring us to prescriptive analytics, the newest wave of sales effectiveness technology enablers, in which the platform not only calculates deal probabilities, but prescribes legitimate coaching opportunities directly linked to the same data. Behavioral modification for quota-carriers, of sorts.

The possibilities here are awesome. Imagine this scenario: An enterprise B2B sales rep, Wendy, told by her manager that her Q3 pipeline isn't full enough, decides to elevate one of her current prospecting conversations, with Acme Widgets, to "opportunity" status in the CRM. This gives the deal a sense of formality and internal publicity that Wendy may not like, but as the boss needs to be satisfied, she enters a deal for $55,000 with an estimated closing date of August 1.

If the CRM is integrated with a true prescriptive analytics platform, the sales force automation (SFA) system does not simply accept Wendy's deal in toto. Rather, it alerts her that while her Acme deal has now been accepted by the official sales data system, the value and timing are actually $35,000 and October 15. "What the … ?! " Wendy exclaims. "I need $55k in early August to fill out my pipe!"

What is the rationale and logic behind this robotic, cold-hearted deal reduction? The holistic SFA "knows" Wendy's deal isn't as strong as she believes, because of any number of single or combined variables. Some of these data findings might be out of her control, such as the historical weaknesses of selling the specific product she's offering to Acme, or Acme's own history in dragging on negotiations or low-balling on price.

Others, though, provide an instant opportunity for hard-earned, professional sales coaching. For example, maybe her own forecasting history reveals over-confidence, or perhaps she hasn't absorbed the relevant product training that her firm knows leads to better sales wins. It could be that she hasn't registered enough BANT criteria about Acme, or she hasn't checked inventory or production capacity before making promises to a buyer. These or a hundred other potential weaknesses mean that Wendy wouldn't last very long on Bill Belichick's New England Patriots, because she simply isn’t doing her job. Or, at least, doing it well enough to earn the right to forecast independently.

Wrapping up this not-so-fictional tale, after Wendy calms down, she actually addresses her problem -- "Now I have to go find more pipeline!" -- with a solution, that of improving the Acme deal by more substantive sales preparation, elevating other opportunities similarly, or both.

Everyone knows that sales is a zero-sum game, with better pipelines resulting in more quotas met and fewer missed soccer games. The prescriptive analytics capabilities behind this tale speak to how proven sales best practices within the enterprise can be leveraged and effectively scaled in concert with the need to provide coaching at an individual contributor level.

Let's Go to the Tape

The body of Aberdeen's research supports this assertion. Data investigated for September 2014's Sheldon Cooper, Sales Whisperer: Applying the Science of Data to the Art of Selling reveals that 49% of Best-in-Class companies provide "real-time coaching for specific deals, opportunities, or accounts," compared with 44% of Industry Average and only 32% of Laggard firms. These top performers back up this commitment by deploying sales technologies more frequently than under-performing survey respondents, such as portal-based libraries of marketing, sales, and training content, customizable sales playbooks, virtual or on-demand learning tools, and internal social collaboration platforms.

Check out the full research report here.