I remember the day I decided to take the leap into full-time self-employment. I’d been juggling a corporate job and freelance work on the side for months and, despite putting in double the hours at my corporate gig, was earning only half of what my freelance work brought in.

One particularly hectic week, as I rushed from my day job to a client meeting, I realized something had to give. I was exhausted, but more importantly, I was holding myself back from pursuing what I truly wanted — the freedom and potential of working for myself full-time.

That‘s when I decided to explore setting up a sole proprietorship. For many, like myself, working for yourself sounds like a dream. If your goal is to own and operate your own business, you’ll likely need to set up a sole proprietorship too.

Whether you're considering becoming a freelance writer like me or exploring another example of sole proprietorship, this guide explores how you can establish your own sole proprietorship, drawing from my personal experience and the lessons I learned along the way.

Download Now: 2024 Entrepreneurship Trends Report

- What is a sole proprietorship?

- What’s a sole proprietor?

- How to Start a Sole Proprietorship

- Advantages of Sole Proprietorships

- Disadvantages of Sole Proprietorships

- Sole Proprietorship Business Examples

- Position Your New Sole Proprietorship for Success

What is a sole proprietorship?

Sole proprietorship is a type of business that is owned and operated by an individual (no partners involved) who pays personal income tax on business income.

Sole proprietorships are not separate entities by law, so they are considered one of the easiest types of businesses to start.

Unlike corporations or LLCs, you don’t have to register with the state. However, you must acquire appropriate permits and licenses to operate legally, and you are personally liable for debts, lawsuits, or taxes your company accrues.

Most businesses in the United States are sole proprietorships. Many entrepreneurs love sole proprietorships because of the ownership they have over business decisions and revenue. These businesses are also easy and cost-effective to set up.

Entrepreneurship Trends Report

Unlock the future of entrepreneurship with this free report from HubSpot and The Hustle.

- 92% of entrepreneurs have no regrets about starting their business.

- 61% find customers through powerful word-of-mouth referrals.

- 37% of entrepreneurs are targeting higher ARR in the next year.

- And more trends!

Download Free

All fields are required.

So, how can you start a sole proprietorship? There’s a step-by-step guide for you below.

Before you start a business, however, it’s important to have a business plan. Here’s an easy-to-use business plan template to begin.

Now that you have the tools to create a business plan, let’s go over the definition of a sole proprietor and the types of sole proprietorships people would typically launch.

What is a sole proprietor?

A sole proprietor is a person who has complete control over the revenue and operations of a business. In addition to taking home all profits, the sole proprietor is also responsible for all debts, lawsuits, and taxes their company accrues. If their business is sued, personal assets like their home, credit score, and savings are unprotected.

Types of Sole Proprietorships

A sole proprietor may operate as an independent contractor (a freelancer), a business owner, or a franchisee.

- Independent contractor: An independent contractor is a self-employed sole proprietor who takes on projects on a contract basis with clients. They have the freedom to choose which clients they take on, but they are often subject to the processes and methods that the client requires.

- Business owner: Business owners can also be self-employed sole proprietors. Unlike contractors, there is much more autonomy in how the work is completed for clients. The operation itself may even be more complex with employees and/or intellectual property.

- Franchisee: Franchise owners may also be sole proprietors. The franchisee benefits from the guidance and business model of a larger brand. In exchange, royalties are paid to the franchisor.

How to Start a Sole Proprietorship

If you want to launch a new business from scratch or you have a side hustle you want to convert into a full-time business, you should consider registering as a sole proprietorship. Here are some steps you can take to get started.

Step 1. Ensure a sole proprietorship is right for you.

First, is starting a sole proprietorship right for you? Or should you launch another type of business?

I spent weeks debating whether to form an LLC or start as a sole proprietor. Ultimately, the simplicity of a sole proprietorship won me over for my writing business.

Not sure what’s right for you?

Jonathan Feniak, J.D., Head of Finance and General Counsel at LLC Attorney, a firm that specializes in startup legal counsel and filing consulting for LLCs, suggests the following criteria when deciding.

“Single-member LLCs are going to be your most straightforward option when you’re a sole business proprietor. This structuring type brings the most liability protections, plus all business profits are simply reported as personal income, which makes managing and filing taxes a lot more straightforward,” Feniak says.

According to Feniak, Professional LLCs are a better choice if you're the sole proprietor of a business within a highly regulated, license-required field. “Think opening a dentist or therapy practice, most financial management businesses, or a law firm,” Feniak says.

Choosing the right business structure for you is key to your venture’s success. As the SBA points out, “The business structure you choose influences everything from day-to-day operations, to taxes, to how much of your personal assets are at risk.”

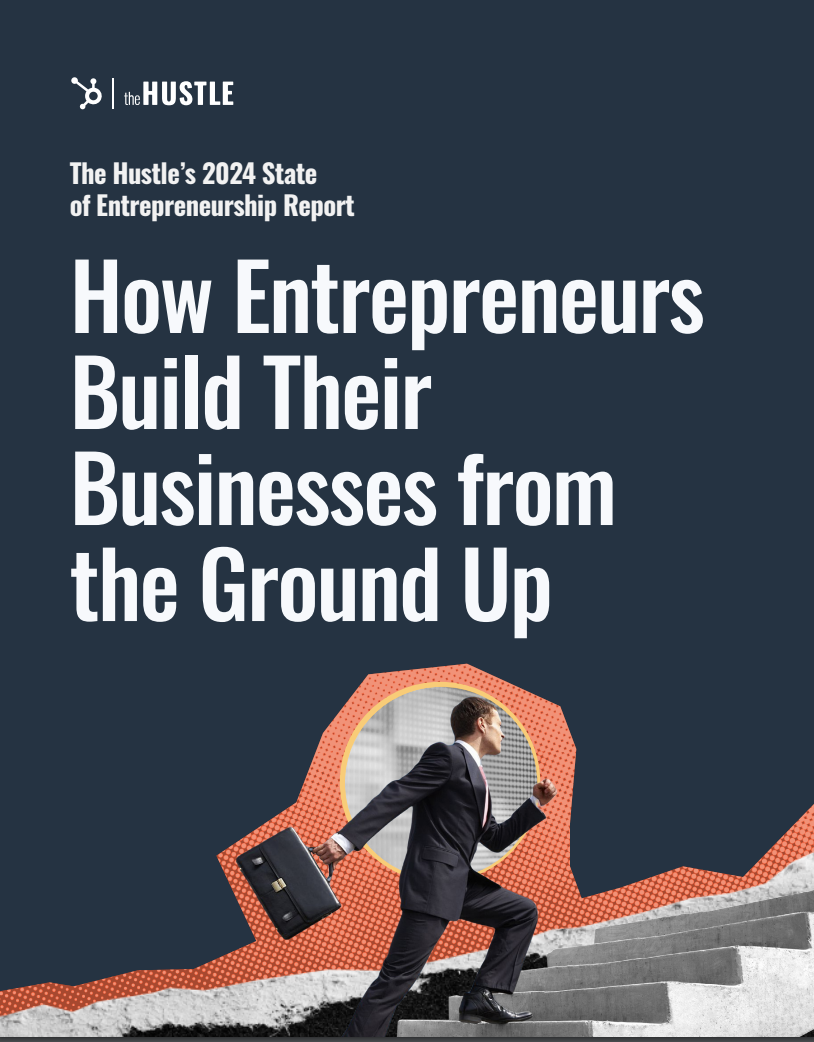

Here’s a table summarizing the differences between LLCs and sole proprietorships.

Sole proprietorships, partnerships, limited liability companies (LLCs), corporations, and cooperatives are just a few of the ways you can structure your business.

There are also notable differences in LLCs compared to S-corps. While sole proprietorships and LLCs are two of the most common business structures, there are key differences between them.

Sole Proprietorship vs. LLC

A limited liability corporation (LLC) provides the business owner liability protection and tax advantages. Meanwhile, sole proprietors bear personal liability for their businesses. Additionally, an LLC can be owned by investors, while a sole proprietorship is usually owned and managed by an individual.

Once you’ve determined a sole proprietorship is right for you and your business, it’s time to talk to the experts.

Step 2. Talk to your nearest Small Business Development Center.

Before you establish your sole proprietorship, reach out to your nearest Small Business Development Center. There, you can learn the steps your state, city, or county requires to operate your business legally.

I can‘t stress enough how helpful this was for me. The advisor I spoke with gave me invaluable advice about local regulations I wouldn’t have known about otherwise.

Free Business Startup Kit

9 templates to help you brainstorm a business name, develop your business plan, and pitch your idea to investors.

- Business Name Brainstorming Workbook

- Business Plan Template

- Business Startup Cost Calculator

- And more!

Download Free

All fields are required.

Step 3. Choose a name.

Choosing a name is the fun part — researching whether or not it’s taken and trademarked is where things become difficult. Search the United States Patent and Trademark Office (USPTO) to learn whether your chosen name has been trademarked.

If it hasn’t, consider filing your name with the USPTO to get a trademark on it, so no one else can operate under that name.

Step 4. Register your DBA.

As a sole proprietor, the legal name of your business is your personal name. However, if you want to operate under a different name, say, “Global Business Consulting Services,” you’d want to register a fictitious or “doing business as” name, also known as a DBA.

In many cases, you’re required to separate business and personal funds. A DBA is often necessary when opening a bank account or credit card for your business. Your state might also require follow-up steps after registration.

Most commonly, you’ll be required to publish the name you’ll be doing business under publicly — and then provide proof of publication to your local government.

A DBA also ensures no one else in your county is doing business under the same name.

Bottom line? Register your DBA, and do it soon.

Step 5. Purchase a domain.

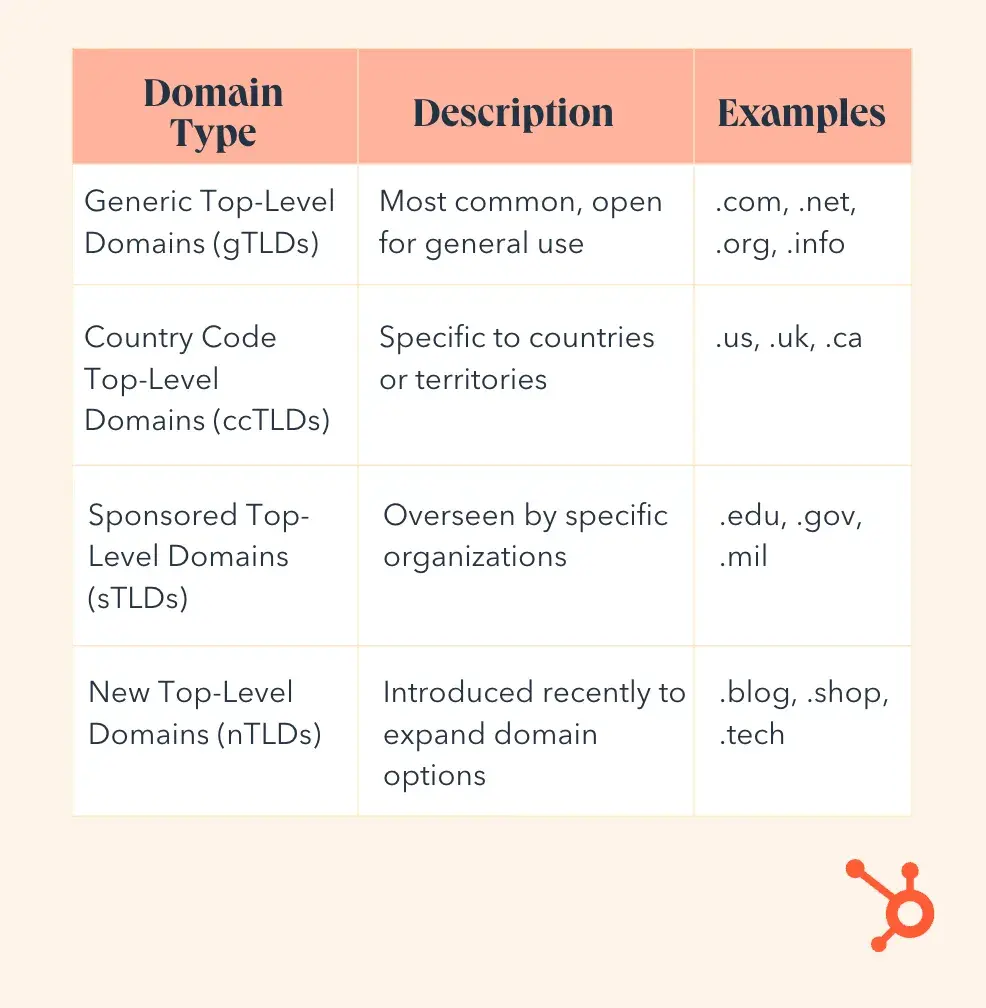

Once you’ve picked the perfect name, it’s time to go after a domain. For an easy client experience, your domain name should be the same as your business. Here are the different types of domains you can explore and what they mean.

Search to see if the domain you want is taken using these ICANN-accredited databases. Even if you’re not ready to build the website, reserve or buy your domain name so no one else can.

Step 6. Register for a business license.

Even sole proprietorships need a business license to operate in most cities. Don’t skimp here. The fines for operating without a license can be steep. You might also need your business license to open a bank account, but more information on that is below.

Step 7. Check on other permits or licenses.

The fees associated with not having the correct licenses or permits can be debilitating for a young business. Be sure that you’ve gotten the correct federal licenses and permits as well as state licenses and permits. These might include:

- A health department permit for preparing or serving food.

- A federal license for transporting animals.

- A health and safety training for opening a daycare.

- A certification exam to become a financial adviser.

- A zoning permit to operate your business from home.

- Registration with the state tax authority if you have employees or collect sales tax.

Do the legwork upfront and find out what licenses and permits you need. The fees you’ll pay during this process are nothing compared to the fines you’ll pay if you haven’t filed the right paperwork.

Step 8. Get an employee identification number (EIN).

If you operate alone, you might not need an employee EIN and can operate and file taxes under your Social Security number. As soon as you hire an employee or set up a retirement plan, however, you must file for a federal employer identification number (EIN). It’s free and can be obtained online.

Step 9. Open a business bank account.

This was a game-changer for me. Keeping my business and personal expenses separate made tax time so much easier. Plus, it made me feel more professional when clients could make checks payable to my business name.

Opening a business bank account ensures a certain level of protection for your business funds. This account also allows customers to pay with a credit card and make checks payable to your business. You can also build a good business credit history.

You want to be able to prove to the IRS that you’re running your business to make a profit. This ensures the losses you experience during the first few years will remain tax deductible.

It’s also wise to build a good credit history before starting your business. While credit cards can help you out in your company’s early days when cash flow is low, the interest adds up quickly and can easily become overwhelming.

A personal loan is often a better option. However, a good credit history is necessary for securing a loan of this type.

Step 10. Load up on insurance.

Because one of the biggest risks to starting a sole proprietorship is the liability, having adequate insurance is a must.

I learned the hard way that insurance is crucial. In my first year, I had a client threaten to sue over a misunderstanding. While it didn't go anywhere, it made me realize how vulnerable I was without proper insurance.

Consider property and liability coverage, auto insurance, health coverage, and disability coverage at the very least. This can get expensive, but it ensures you and your personal assets are protected from lawsuits and professional setbacks, should they arise.

Check out this SBA article to learn more about the coverage you need.

Step 11. Pay your taxes.

As a sole proprietor, you'll need to file various tax forms depending on your business activities.

I remember when I first started my freelance writing business, I was overwhelmed by the tax requirements. But with some research and help from a tax professional, I got the hang of it. Here's a breakdown of the common forms categorized by tax type:

|

Income Tax |

|

|

Self-Employment Tax |

|

|

Estimated Tax |

|

|

Social Security and Medicare Taxes |

|

|

Federal Unemployment Tax |

|

Remember, because you’re self-employed, your paychecks don’t have proper withholdings taken out at the time you’re paid. Instead, you can expect to pay quarterly estimated tax payments. You’ll then cover the difference or receive a refund for any shortage or overage come tax season.

Because of this, set aside money from each paycheck to cover those quarterly and annual expenses.

Entrepreneurship Trends Report

Unlock the future of entrepreneurship with this free report from HubSpot and The Hustle.

- 92% of entrepreneurs have no regrets about starting their business.

- 61% find customers through powerful word-of-mouth referrals.

- 37% of entrepreneurs are targeting higher ARR in the next year.

- And more trends!

Download Free

All fields are required.

Advantages of Sole Proprietorships

In my experience, the freedom and flexibility of being a sole proprietor have been incredible. Here are some benefits I've enjoyed.

1. Full Decision-Making Authority

As a sole proprietor, you’re fully responsible for making choices and decisions for your business. As opposed to a partnership or an LLC, you don’t need to consider the opinions of shareholders or legal partners. You are free to steer your business in any direction you think works best.

2. Easy to Set Up

A sole proprietorship is much easier to set up than other business forms.

As a sole proprietor, you don’t have to think about legal contracts with other business partners. You also don’t have to do other laborious tasks that other business enterprises require, like giving stock to shareholders or choosing a board of directors.

When I started my freelance writing business, I was surprised by how quickly I could get up and running.

All I needed when I started was my laptop. And within a few hours, I had chosen my business name, set up a simple website, and created my first invoice template. The simplicity was liberating — I didn't have to wade through complex paperwork or consult with lawyers to get started. By Monday, I was ready to take on my first client!

However, while the setup is simpler, there are still some legal requirements to fulfill. You'll need to obtain the necessary licenses and permits to operate your business legally. These might include sales tax permits or zoning permits, depending on the nature of your business and your location.

In my case, I only needed a basic business license from my city. I was relieved to find that I could apply for it online, and the whole process took less than an hour. This small but crucial step gave me the confidence to officially call myself a business owner.

The licenses and permits you’ll apply for depend on the type of business you want to run. Check with your local or state government to learn exactly which ones you’ll need.

3. Lower Up-Front Cost

Starting a sole proprietorship is free for the most part. Of course, you’ll have to pay to register your business name, get your business domain, and get the necessary licenses or permits, but you won’t pay the $1,000 average cost of starting an LLC.

This is great if you’re working with a tight budget because you won’t have to invest a lot of money into the business before you begin operations.

4. Simple Tax and Lower Tax Rates

Sole proprietorships have fairly simple and straightforward tax requirements compared to other business entities.

In terms of tax filing, sole proprietorships are taxed as a pass-through business entity. This means that the business’ profits and losses are reported on your personal income tax return. So you don’t have to pay separate taxes for your business.

I remember when I first started my freelance writing business, I was worried about the complexity of taxes.

But I was pleasantly surprised by how straightforward it was. During my first tax season as a sole proprietor, I was able to deduct a portion of my home office expenses which reduced my tax bill by a lot. It felt great to see my hard work pay off in terms of tax savings!

How does this work? Simple: If you use your own home as your business base, you won’t have to pay more money for space, utilities, and the internet. This reduces your personal taxes. You might even get a tax refund when you file your personal tax return.

As a sole proprietorship, you can also take advantage of some tax deductions. For instance, the Tax Cuts and Jobs Act of 2017 allows sole proprietors to deduct 20% of their net income from their taxes.

Additionally, there’s no distinction between the owner and a sole proprietor. Therefore, the IRS does not require separate accounting records for the business — including balance sheets — as part of their tax return. This simplified my bookkeeping immensely. Instead of juggling multiple sets of books, I could focus on what I do best: writing for my clients.

5. Full Control Over Revenue

As a sole proprietor, you’re in charge of all aspects of your business, including revenue. You decide how much you want to pay yourself and contractors (if you have any). You’ll also choose how much you want to pour back into the business.

Entrepreneurship Trends Report

Unlock the future of entrepreneurship with this free report from HubSpot and The Hustle.

- 92% of entrepreneurs have no regrets about starting their business.

- 61% find customers through powerful word-of-mouth referrals.

- 37% of entrepreneurs are targeting higher ARR in the next year.

- And more trends!

Download Free

All fields are required.

Disadvantages of Sole Proprietorships

As with all business models, sole proprietorships have disadvantages as well. Here are some of them.

1. Risking Personal Assets

As a sole proprietor, you’re responsible for the financial aspects of your business, including taxes, contractor wages, and any legal contingencies. What’s more, sole proprietorships don’t offer legal protection over your personal assets if you get into financial trouble.

This means if your business is sued or you have to file for bankruptcy, the court has the right to seize your personal assets to cover these expenses. That includes your savings, home, cars, and other belongings.

Sure, insurance coverages can help with this, but they’re not foolproof.

2. Difficulty Raising Capital

While the initial costs of starting a sole proprietorship are low, raising capital to finance the business can be difficult. That’s because banks prefer to support incorporated businesses.

Banks consider the sole proprietorship model to be risky, as the owner’s personal assets are usually limited and can run out at any time. Financial institutions are usually reluctant to issue credit or give out loans to sole proprietors for fear that they won’t be able to repay them.

Sole proprietorships may also struggle to get buy-in from investors, as they’re not designed to have shareholders. Without loans and investments, it’s harder to take a sole proprietorship to the next level.

3. Self-Employment Tax

As a sole proprietor, you’re liable to pay a self-employment tax of 15.3% (12.4% in Social Security taxes and 2.9% for Medicare) on all income generated by the business.

While the 12.9% Social Security taxes are constant, the Medicare tax rate increases by 0.9% once you cross certain threshold levels. In the long run, this tax can become significant.

4. Perceived Lack of Professionalism

It’s not uncommon for potential investors and clients to view a sole proprietorship as less professional than a corporation or LLC. They may also be wary of doing business with an individual, as opposed to a separate legal business entity. You should keep this in mind if you might consider an LLC as an option for your business.

Sole Proprietorship Business Examples

Sole proprietorships are a great choice for people who want to turn their side hustles into something a little more serious — and lucrative. A variety of businesses are operated as sole proprietorships.

As you explore these examples, tools like HubSpot's Starter Bundle can be invaluable for managing and growing your sole proprietorship. This bundle includes integrated marketing, sales, and customer service tools — plus educational resources and customer support to back you up. These resources streamline operations, regardless of which type of sole proprietorship you choose.

Here are some common examples of sole proprietorship businesses.

1. Web Developer

Web developers design websites for clients using web coding languages, such as HTML, CSS, JavaScript, PHP, and jQuery. An easier entry point into this field would be WordPress web development. This is a popular example of sole proprietorship in the tech industry.

2. Digital Marketer

Digital marketers do anything from managing a brand’s social media accounts to improving a brand’s SEO. Be sure to specialize rather than offering all marketing services.

3. Virtual Assistant

Business owners are busy. They don’t want to hire an office assistant, especially because most tasks can be done online. Enter the virtual assistant.

As a sole proprietor running a virtual assistant business, you’d handle tasks such as bookkeeping and database entry for other business owners.

4. Daycare Operator

Daycare operators run small, affordable daycare facilities for parents who can’t afford expensive day schools or a dedicated nanny. A background education would be helpful before creating a daycare business.

You could, alternatively, run a dog daycare or a daycare for the elderly.

5. Freelance Graphic Designer

Graphic designers create beautiful things: landing pages, brochures, flyers, and social media ads. As with digital marketing, you should specialize in either digital or print graphic design and target certain industries that interest you. Creating a banner for a hair salon would be much different from creating one for an engineering firm. You’ll also need a graphic design portfolio.

6. IT Consultant or Computer Specialist

Have you ever run into IT problems? So do countless businesses. As an IT consultant running your own business, you would offer IT troubleshooting services to other companies. You’ll also resolve issues with both the company’s hardware and software solutions. Be open to traveling for this type of sole proprietor business.

7. Freelance Writer

As a freelance writer with a sole proprietorship, you would target brands that need content written for them. These may include nonfiction articles, news articles, blog posts, website pages, and social media ads. As with digital marketing and graphic design, consider specializing in one writing form.

8. Freelance Copy Editor

Freelance copy editors edit someone else’s writing for clarity, concision, and effectiveness. These editors proofread someone else’s work for errors. They also focus on the flow and cohesion of ideas.

You can either go into fiction or nonfiction copy editing. Alternatively, you can become a copy editor specifically for websites and blogs

9. Freelance Non-Fiction Book Editor

Nonfiction book editors typically review highly technical or specialized material for flow, accuracy, and logic. These editors are different from other types because they exclusively specialize in manuscript-length works and have an advanced degree in the topic they specialize in.

10. Fitness Coach

Fitness coaching is a great choice if you have a passion for fitness. This type of sole proprietor typically targets gym goers — or those who’d like to start — to help them reach their fitness goals through a customized program. A degree in exercise science would be beneficial, as well as a certification in fitness coaching.

11. Housekeeper

Housekeepers clean houses with more thoroughness than a busy homeowner would. Tasks include mopping, sweeping, taking out the trash, washing dishes, and doing laundry. For optimal success as a sole proprietor, you should target a small geographical area to pitch your housekeeping services.

12. Landscaper

Landscapers mow lawns, trim bushes, check the soil’s health, and do everything related to backyard and front yard maintenance. You can offer something simple, such as lawn mowing, and slowly add more services as you gain more advanced land care knowledge.

13. Caterer

Like cooking? Then a catering sole proprietorship may be for you. Caterers cook large amounts of food for other people’s events and typically take care of delivery and setup. Instagram is a great platform to spread the word about your business.

14. Baker

An alternative sole proprietorship for those who enjoy cooking would be a baking business. You can either specialize in sweets or savory goods, or offer a mixture of both. While we often associate bakers with brick-and-mortar bakeries, you can operate this business out of your home and arrange local pickups.

15. Accountant

As a freelance accountant, you would work with small-business owners and audit their inflow and outflow of cash. Be sure to be proficient in at least one accounting software, such as QuickBooks or FreshBooks.

Entrepreneurship Trends Report

Unlock the future of entrepreneurship with this free report from HubSpot and The Hustle.

- 92% of entrepreneurs have no regrets about starting their business.

- 61% find customers through powerful word-of-mouth referrals.

- 37% of entrepreneurs are targeting higher ARR in the next year.

- And more trends!

Download Free

All fields are required.

16. Tax Preparer

Tax preparers target individuals who find tax return documents inaccessible and difficult to fill out. This is one of the easiest sole proprietorships to launch, as there are no education requirements. A course in tax preparation is all you need.

17. Document Assistant

Document assistance is similar to tax preparation. You would help individuals fill out highly complicated forms — such as immigration applications, visa applications, and unemployment claims. You may also submit them on your client’s behalf.

Proficiency in another language would be beneficial, as those who need assistance are typically non-English speakers.

18. Resume and Cover Letter Writer

Resume and cover letter writers serve those who have a disparate collection of job descriptions, roles, and skills. They then turn the information into an effective resume. A background in writing would be beneficial if you plan to launch this type of sole proprietorship.

19. Event Planner

As a sole proprietor with an event planning business, you would handle all facets of the event planning process. That includes finding a venue, caterer, decorator, DJ, and event furniture supplier. You’ll typically handle part of the event setup as well. One particularly lucrative specialization is wedding planning.

20. Photographer

Freelance photographers take photos and video footage of virtually anything that clients want to capture. As with most business types on this list, you should specialize. A corporate photographer takes photos of a company’s staff. A wedding photographer takes photos of a wedding in an artful way. A maternity photographer takes maternity shoots. These three require different skill sets, so choose the one that best matches your background.

21. Standardized Test Tutor

As a standardized test tutor, you would coach high school and college students to improve their scores on the SAT, ACT, GRE, GMAT, or LSAT standardized tests. You should specialize in one or two tests.

Be sure to advertise the high score you received on your website. A background in education would be helpful.

22. Translator

You can start a translation business if you have advanced or native proficiency in a language other than English. Businesses, churches, and schools need translators to communicate with non-English-speaking clients or groups. You can start this type of business without a degree, but certification would be beneficial.

23. Ecommerce Store Owner

Selling products online has never been easier, thanks to platforms like Shopify, Etsy, or Amazon. You can curate products, create your own, or dropship items.

This business model offers flexibility and scalability and allows you to start small and grow as demand increases. With the right niche and marketing strategy, an e-commerce store can become a lucrative sole proprietorship.

24. Social Media Manager

Businesses need help managing their online presence. Offer services like creating content, scheduling posts, running ads, and engaging with followers. You can specialize in one platform like Instagram or LinkedIn or across multiple platforms.

As a social media manager, you'll need to stay up-to-date with the latest trends and algorithm changes across various platforms. This role often involves analytics and reporting to show the value of your services to clients.

25. Online Coach or Consultant

If you have expertise in a specific area, you can offer coaching or consulting services online. This could be in fitness, nutrition, business, career development, or any other field where you have valuable knowledge to share.

Building a strong personal brand and demonstrating your expertise through content marketing can help attract clients. Consider creating online courses or group coaching programs to scale your business.

26. Content Creator

The demand for high-quality content is booming. You can create videos, podcasts, blog posts, or other forms of content for your own platform or for clients.

Success in this field often requires developing a unique voice or perspective that resonates with your target audience. Content creators also diversify their income streams by incorporating sponsorships, merchandise, or paid subscriptions into their business model.

Position Your New Sole Proprietorship for Success

Starting my business as a sole proprietor was one of the biggest and best decisions I've ever made. Though the risk was great, so was the reward. The best part was that I could start it on my own without leasing a building, hiring others, or requiring expensive training.

Whether you choose freelance writing, photography, or e-commerce, each example of sole proprietorship offers unique opportunities and challenges. Remember, every business journey is unique. What worked for me might not be the perfect solution for you, but I hope my experiences can guide you along the way.

Editor’s note: This post was originally published in September 2018 and has been updated for comprehensiveness.

Entrepreneurship Trends Report

Unlock the future of entrepreneurship with this free report from HubSpot and The Hustle.

- 92% of entrepreneurs have no regrets about starting their business.

- 61% find customers through powerful word-of-mouth referrals.

- 37% of entrepreneurs are targeting higher ARR in the next year.

- And more trends!

Download Free

All fields are required.

![What I’ve Learned About Selling Online Courses (and How You Can Too) [+ Expert Insight]](https://53.fs1.hubspotusercontent-na1.net/hubfs/53/sell-webinar%20%281%29.jpg)

![What is a Silent Partner? [+How to Find One For Your Business]](https://knowledge.hubspot.com/hubfs/silent-investor-1-20250124-8605371.webp)

![Debt-to-Equity Ratio, Demystified [+Helpful Formulas]](https://knowledge.hubspot.com/hubfs/debt-to-equity-1-20250115-1477462.webp)